Due to the increasingly volatile market, Shawbrook is making another series of immediate rate changes across all of their products – Buy-to-Let, Commercial and Semi-Commercial, Bridging and Second Charge Mortgages.

From 3:30pm today, their systems will be unavailable for a short while whilst they implement some revised price points across their Buy-to-Let, Commercial and Bridging product ranges. These will go live immediately at 4pm.

New Seconds pricing will be live from tomorrow morning.

Please note that existing pipeline cases will not be impacted.

Pipeline: All Bridging, Buy-to-Let, Commercial and Semi-Commercial cases where at least an IMO has been issued (that is less than 14 days old) before 3:30pm on Wednesday 28 September will be honoured on the existing rates. However, if there is no change in case status within 14 days of the IMO being issued, the case will have to proceed on the new rates (if applicable).

Seconds Pipeline: All cases that were entered on DJ Broker Hub prior to Thursday 29 September will be honoured on the former pricing, as long as the binding mortgage offer is issued before Thursday 27 October 2022.

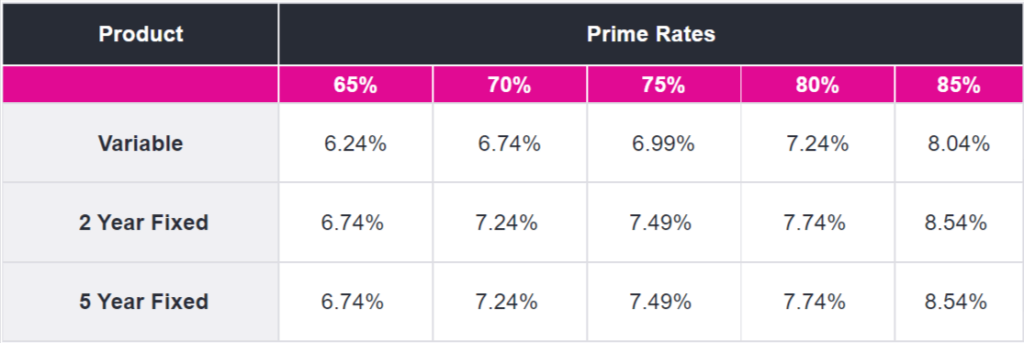

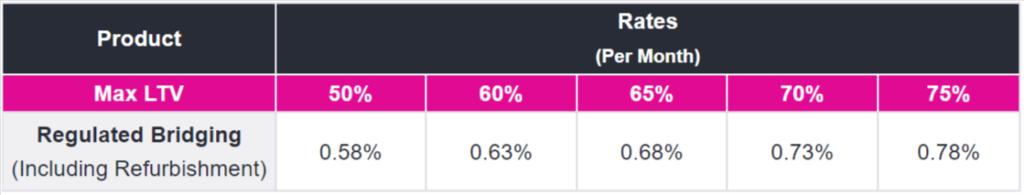

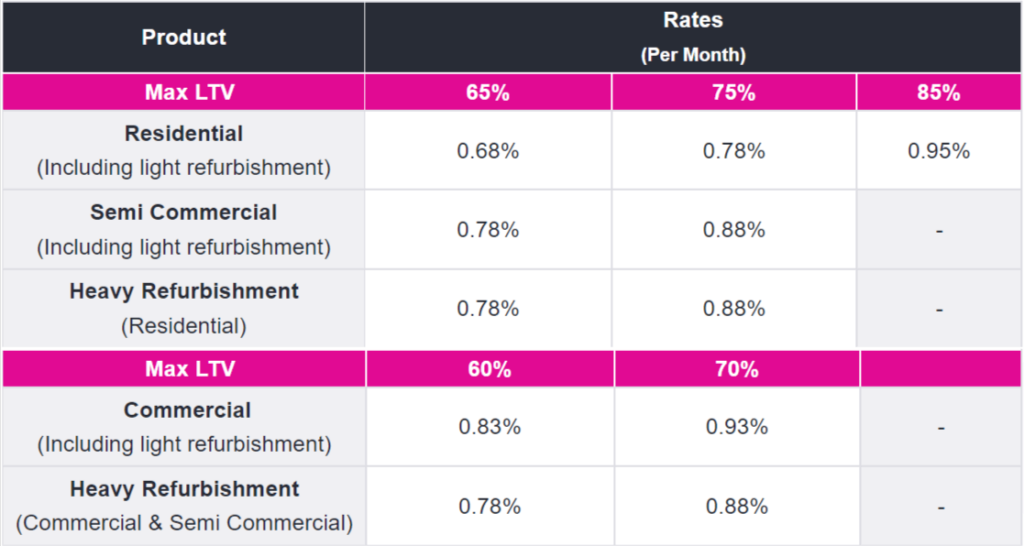

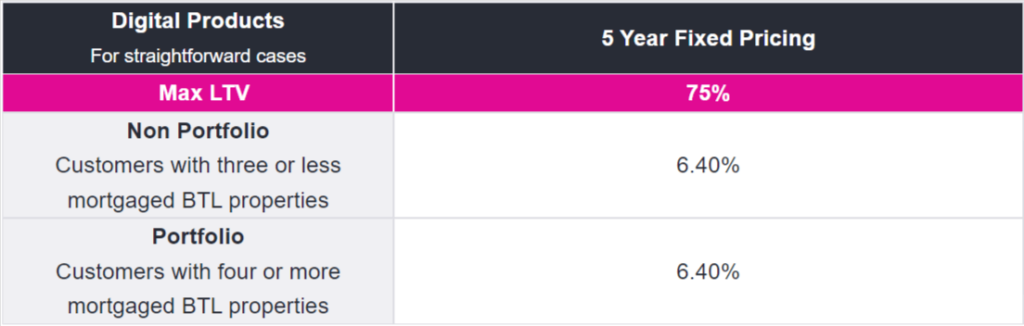

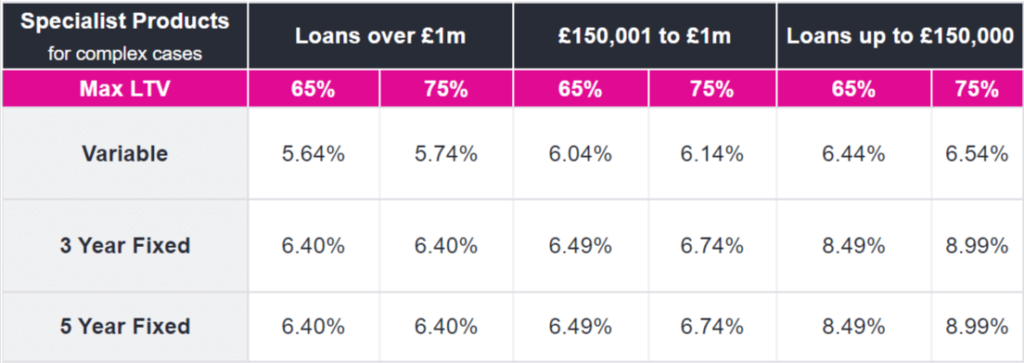

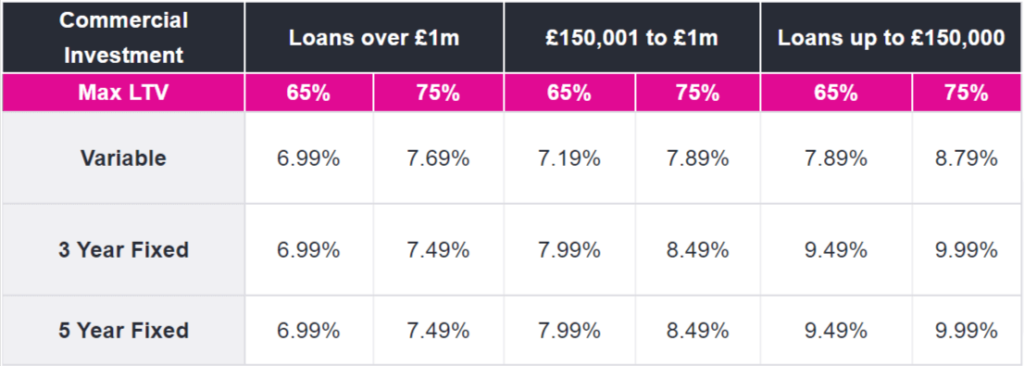

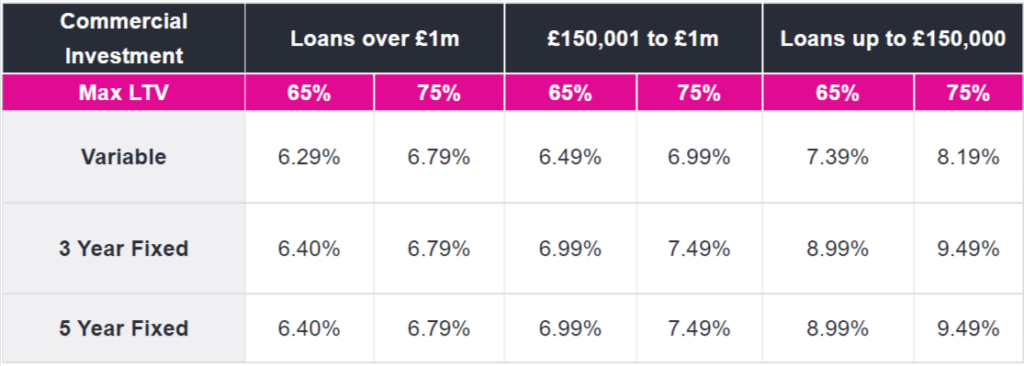

Please refer to the following tables for product pricing which will be live and applicable with immediate effect:

Regulated Bridging

Loans from £50k – £5m

Arrangement fee: 1.95% added to the loan outside of max LTV’s

Unregulated Bridging

Loans from £50k – £25m

Arrangement fee: 2% added to the loan outside of max LTV’s

Buy-to-Let

Loans from £40k- £25m

Arrangement fee: 2% added to the loan outside of max LTV’s

Commercial Investment

Loans from £50k- £25m

Loan to value up to 75% of vacant possession or market value

Arrangement fee: 2% which can be added to the loan.

Semi-Commercial

Loans from £50k- £25m

Loan to value up to 75% of vacant possession or market value

Arrangement fee: 2% which can be added to the loan.

Second Charge Mortgages

Loans from £5k (£10k up to 75% LTV)

Loans up to £500k (£200k max loan at 80% LTV, £150k max loan at 85% LTV)

Arrangement fee: £795 which can be added to the loan.

They are grateful for your continued support and want to ensure they can repay that by continuing to be there for you and your customers in these uncertain times.

If you require support or further information, please do not hesitate to contact them. These changes will be reflected on their website and product guide ASAP and will be circulated as soon as they are available.