Shawbrook Real Estate changes to their Buy-to-Let, Commercial and Semi-Commercial products. The following changes will be effective from Wednesday 19 October 2022:

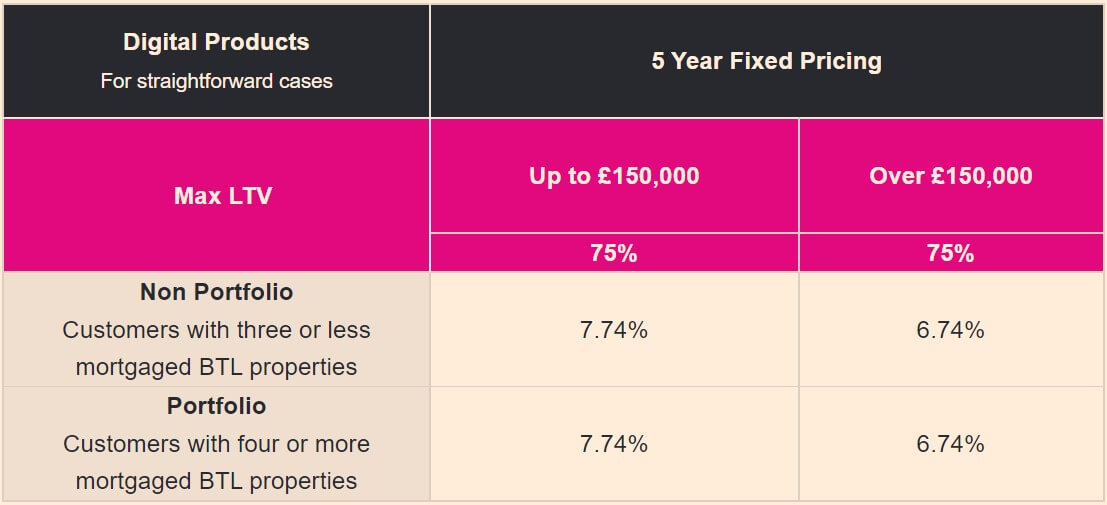

New Pricing for Digital Products

To enable them to continue to support a wide range of customers with their award-winning digital Buy-to-Let proposition, they are introducing a new price point for loans under £150,000. Loans for their digital products will start from 6.74%.

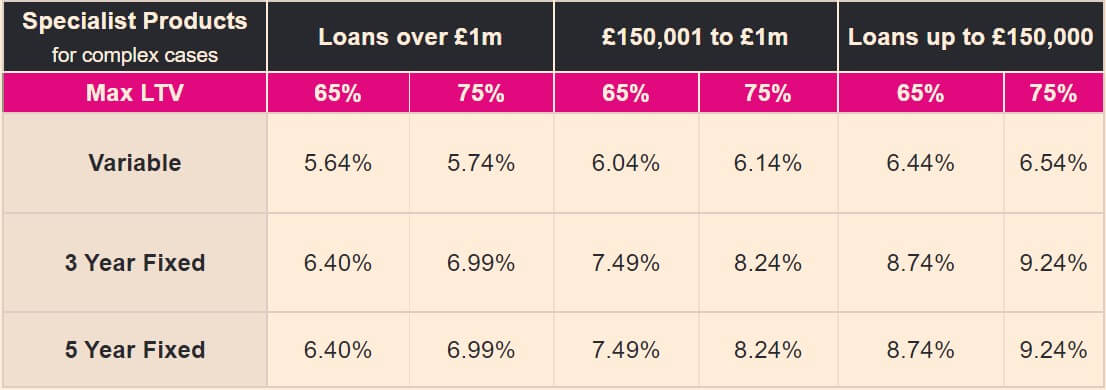

Fixed Rate Changes

Increases to their fixed rates across their Specialist Buy-to-Let products, now starting from 6.40%

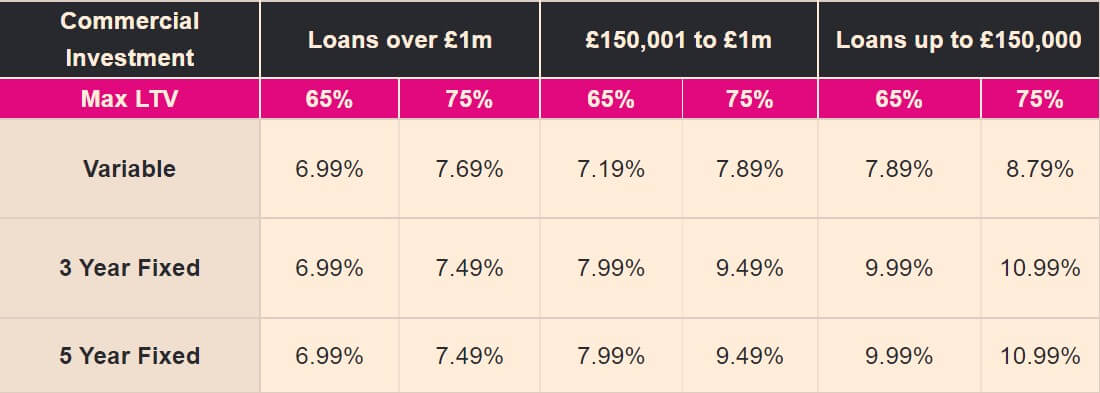

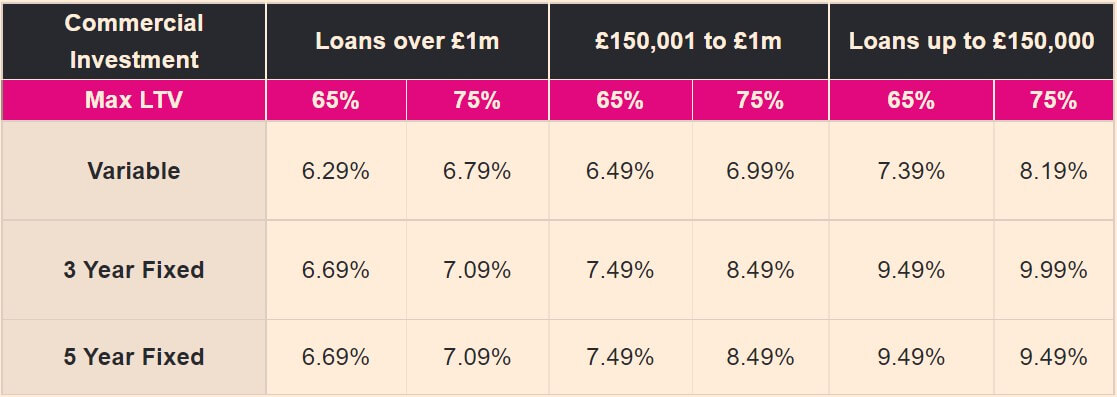

Increases to their fixed rates across their Commercial and Semi-Commercial products, now starting from 6.69%

Lending Criteria Changes

They will also be temporarily removing wholly Retail Property as acceptable security across their Commercial Investment offering. They will still consider semi-commercial properties or multi-unit properties where there is an element of retail in the asset.

These changes reflect the need to make sensible risk appetite adjustments in this fast-moving market. It is important to them that they provide you and your clients with clarity, and they are committed to remaining transparent and supportive during this period of change.

Please note that existing pipeline cases will not be impacted.

Pipeline: All cases where at least an IMO has been issued (that is less than 14 days old) before 5:30 pm on Tuesday 18 October will be honoured on the existing rates. However, if there is no change in case of status within 14 days of the IMO being issued, the case will have to proceed on the new rates (if applicable).

Please refer to the following tables for product pricing which will be live tomorrow morning:

Buy-to-Let

Loans from £40k- £25m

Arrangement fee: 2% added to the loan outside of max LTV’s

Commercial Investment

Loans from £50k- £25m

Loan to value up to 75% of vacant possession or market value

Arrangement fee: 2% which can be added to the loan.

Semi-Commercial

Loans from £50k- £25m

Loan to value up to 75% of vacant possession or market value

Arrangement fee: 2% which can be added to the loan.

SLA Notice: Buy-to-Let, Commercial and Semi-Commercial cases are currently taking at least 30 working days to be worked, with 93% of valuations being reviewed in that time period. They are responding to 97% of broker queries within 48 hours. This notice does not apply to Bridging cases.

If you require support or further information, please do not hesitate to contact them. These product changes will be reflected on their website tomorrow morning, along with the new criteria guides.