To assist you in meeting the requirements of The Consumer Duty, we have created a new tab on a client record in OMS called ‘Consumer Duty’.

This tab should be treated as an ‘aide memoir’ of the principles of The Consumer Duty and the areas that advisers need to consider in all their dealings with their clients.

This includes:

- Vulnerable customers

- Foreseeable harm

- Customer Understanding

- Fairvalue

Should the answers indicate the client is potentially vulnerable, you will be directed to turn on a vulnerability flag by completing the section at the bottom of the applicant details tab.

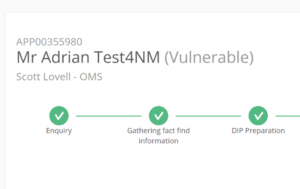

When you tick yes to one of these questions, the word ‘Vulnerable’ will appear against the client’s name as seen below:

The vulnerable flag against your client’s name will only be seen by yourself and the internal team and will not be seen by the client if you use the customer portal.

Forseeable Harm

Further information on the FCA requirements for each of these areas can be found in BOX. We have also written a recent blog specifically about foreseeable harm.

For mortgage advisers, this means taking steps to ensure that they know their clients well, understand their short and long-term needs, recommend the right products and services to their clients and provide them with clear and accurate information.

Read the blog ‘How to Avoid Causing Foreseeable Harm as a Mortgage Adviser’

to see specific examples of what could be deemed to be foreseeable harm.

Please do not hesitate to contact the Compliance Team for further information or guidance.

Kind Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110