Most people have heard of the term vulnerable customers, and even know what type of people may be classed as vulnerable, but do you know what to do when someone is identified as vulnerable?

Before we cover what help can be given to vulnerable customers, let’s look at who might be vulnerable and the scale of how many people are actually classed as vulnerable.

The FCA definition of vulnerable

A vulnerable consumer is someone who, due to their personal circumstances, is especially susceptible to detriment, particularly when a firm is not acting with appropriate levels of care.

For the FCA’s full guidance on vulnerable customers, please read HERE

Vulnerability can come in many guises

Many people assume vulnerable people refers to the elderly or disabled, but in fact, vulnerability can come in many guises, such as:

Age (young and old): Someone who is young could be vulnerable due to having less experience in life making them more susceptible to fraud or manipulation. Someone who is old, or just older than the person they are talking to may struggle with terminology or technology.

Mental health: In any given year, one in four adults experience at least one mental disorder and may then find it difficult to deal with their finances. You may see erratic spending on their bank statements or missed payments on their credit report.

Physical health: 16% of working age adults have a disability. This may result in them finding it difficult to so simple tasks such as post a letter or answer the phone.

Low literacy: One in seven adults has literacy skills that are expected of a child aged 11 or below. Many people are having to talk to brokers in their second language and may struggle to understand important parts of the mortgage advice process.

Life changing events: Such as illnesses to themselves or a family member, or are going through a divorce or the even the death of a friend or family member. These events could result in unusual behaviour such as anger or crying over the phone.

Caring responsibilities: More and more people have caring responsibilities for family members, which means they may struggle financially or with just time to deal with other matters.

Financial hardship: Almost half of adults do not have enough savings to cover an unexpected bill of £300. Also, 1 in 2 adults in the UK with debt problems has mental health issues.

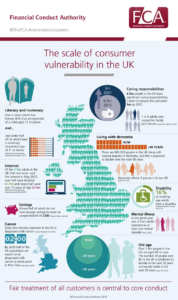

The Scale of Consumer Vulnerability in the UK

What to do

So, what should we do when we identify someone as vulnerable and what impact will this have on them being able to get a mortgage?

A useful tool to help follow the correct process is the TEXAS model.

TEXAS was originally developed following a study on mental health and debt collection, but it has become a tool that is used across the sectors to handle a wider range of vulnerable situations.

It helps ensure staff record:

- the most relevant information about characteristics of vulnerability,

- how these characteristics affect support needs, while

- helping to meet data protection requirements.

The steps of the model include:

- T Thanking the customer for their disclosure.

- E Explaining how their disclosed information will be used.

- X Depending on the basis on which the data will be processed either: eXplicit consent is sought or cheXs (‘checks’) are made to ascertain if the customer objects to data processing.

- A Asking the customer questions to find out key information to understand the situation better.

- S Signpost to internal support, or to external services with specialised expertise (where this is appropriate).

So, how does this look in practice?

When you identify a client who is vulnerable, firstly, you thank them for letting you know, because it is never easy to discuss these types of things.

Then you explain to them that now they have explained what vulnerabilities they have, what you will do with that information, such as note it on their file, so they won’t have to explain to anyone else. This includes the lender so they can continue to provide appropriate support. Following Consumer Duty, more and more lenders are asking for us to let them know if a client is vulnerable as they want to ensure they treat the customer fairly and appropriately. It is important to let the client know that the lender will not exclude the customer from any services due to their vulnerability.

Now the customer is aware of how this information will be used, you seek their permission to use it in this way.

So long as the customer is happy for you to register them as vulnerable, you should ask what help they will need? For example, if English isn’t their first language, do they need you to speak to a family member or send further details in a letter so then can take more time to review it.

Lastly, in some cases, they may need help beyond what you can offer, and in these situations the client should consider speaking to an expert. There are many free support charities or advice lines who can help with many situations, or they could discuss their issues with their doctor who can provide appropriate medical advice.

Just because someone is classed as vulnerable, does not mean they should be excluded from your services.

Being vulnerable doesn’t mean they should not get a mortgage, being vulnerable just means your client may need additional time or support from you to help them.

If you would like any further information on vulnerable customers, you can also read Connect’s Vulnerable Customers Policy HERE

Should you have any questions on this, please do not hesitate to contact myself or the compliance team.

Regards

Alan Baldwin

Director of Compliance

Call : 01708 676110

Email : compliance@connectmortgages.co.uk