SDLT Increases: How to prepare for the increase coming into place.

SDLT Increases: How to prepare for the increase coming into place.

Following the announcement from the Autumn Budget, the Stamp Duty Land Tax (SDLT) thresholds are changing from 1st April 2025, introducing a 2% SDLT rate for properties priced between £125,001 and £250,000.

This, alongside the 5% higher rates surcharge, means landlords and investors may face increased upfront costs on property purchases meaning that landlords will now be paying an additional 7% total SDLT. This of course depends on the total cost of the property price.

For example, a £350k house currently has to pay a stamp of £22,500, but from the 1st April, it will be £25,000, which is an increase in stamp duty payment of 11%.

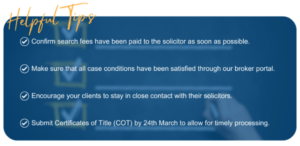

We’re here to help you and your clients navigate these changes smoothly. By completing purchases before 31st March 2025, your clients can benefit from the current SDLT rates.

These small steps can make a big difference in ensuring your clients complete their purchases before the new thresholds take effect.

Want more details? We’ve outlined everything you need to know about the SDLT changes in an article on our website.