Great news! We’ve improved our Buy to Let criteria to help your landlords get the best out of their investments. For your clients who wish to remortgage with no extra borrowing we’ll now consider rental income which is at least 125% of the monthly interest for Interest Cover Ratio (ICR) applications.

Criteria at a glance:

- No minimum income required

- Ability to pay is assessed on rental income (which must be received in GBP)

- Minimum loan size £100,000 (exclusive of any product fees)

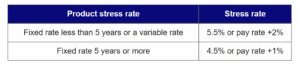

- The rental income must be at least 125% of the monthly interest due inclusive of any product fees added to the loan. This is calculated using the relevant stress rate below (whichever applies):

To find out how much your client can borrow on a Like-for-Like Buy to Let Remortgage enter their details into our online Buy to Let calculator today!

For more information about our other Buy to Let solutions, head over to our website.

We’re right here for you and your clients.