Applies to: Buy to Let New Business

Accord have changed their rental calculation requirements for your Landlord clients by reducing our ICR Rates.

What’s changing?

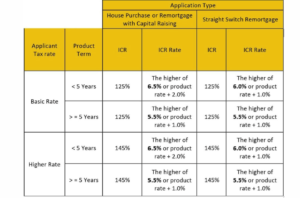

Interest Coverage Ratio Rates (ICR Rates) reductions

Where your client is capital raising:

- Product term < 5 years – 6.5% (previously 7.5%) or product rate +2% (whichever is higher)

- Product term >= 5 years – 5.5% (previously 6.5%) or product rate +1% (whichever is higher).

For straight switch Remortgage applications:

- Product term < 5 years – 6.0% (previously 6.5%) or product rate +1% (whichever is higher)

- Product term >= 5 years – 5.5% (previously 6.5%) or product rate +1% (whichever is higher).

Full details of our rental criteria are below:

We recommend you continue to use the rental calculator on the Accord website to determine the maximum borrowing based on our available products before you submit a DIP.

For any FMAs submitted before 8pm on 4 April, ICR Rates at the time of submission will apply. If you have an existing application that would benefit from the new rental criteria, please contact your BDM for help.