Concessionary Purchase could help your customers access a cheaper mortgage rate in comparison to a high LTV rate that might ordinarily be associated with first-time buyers.

Concessionary Purchase could help your customers access a cheaper mortgage rate in comparison to a high LTV rate that might ordinarily be associated with first-time buyers.

Take a look at how Concessionary Purchase helped Emma and Will.

“We’re delighted to have become homeowners whilst staying in our current property. Pepper and Lina were a great help to us, ensuring we could borrow as much as possible helping us to get our dream home. Pepper were reassuring at every stage and worked quickly to help us with a speedy turnaround.”

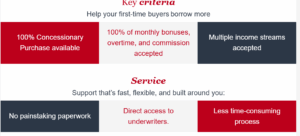

Emma and Will had been happily renting their beloved home for the last three years but were ready to take the next step into homeownership. Navigating early parenthood and maternity leave had made it challenging for them to show sufficient affordability through traditional lenders.

Emma earned monthly commission, and Will juggled two jobs, with income patterns that had previously stood in the way of securing a mortgage.

Due to recent changes in the Buy to Let market and the associated tax implications, Emma and Will’s landlord was keen to sell quickly. Recognising their love for the property, their landlord offered to sell it to them at a significantly reduced price, saving them a substantial £50,000 off the market value.

See how we worked with their broker, Lina, to help them fulfil their mortgage ambitions: