changes to mortgage documentation for self employed CUSTOMERS

We understand there are a number of businesses which have been temporarily impacted by Covid-19 and may have received financial support from the Government.

We are committed to helping business owners with their mortgages and therefore we are changing our mortgage documentation requirements to enable us to consider applications from self-employed customers temporarily impacted by Covid-19.

What’s changed?

As part of our commitment to responsible lending, we’re introducing a Self-Employed Supplementary Form for applications from self-employed customers. This is to help us understand what impact the Covid-19 restrictions have had on their business. It will also help us to understand any changes they have made to their business model.

In addition to the form, we continue to require three months’ business bank statements to evidence current trading levels. We can only consider applications from customers where their business has been actively trading for the last three months and the customer can demonstrate current trading levels.

If a customer’s business has been impacted by Covid-19, we will use this information to undertake a tailored assessment.

If a customer’s business has not been impacted by Covid-19, we will undertake our usual assessment.

Additional information

The new Self-Employed Supplementary Form will be required for all applications submitted from Friday 7 August.

This change does not apply to day rate contractors where the application meets our contractor policy.

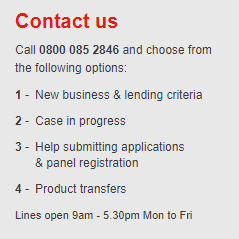

For further details, please contact your dedicated Business Development Manager.

The Clydesdale Bank Intermediary Team