The risk from AI (Artificial Intelligence) fraud has significantly increased recently with the advances that have been made in AI technology.

AI is being used to help in financial services with many lenders now using AI to help speed up the underwriting process, but as well as the benefits, there are also risks.

What is AI Counterfeit?

AI counterfeit refers to the use of artificial intelligence technologies to create fake or forged items, documents, digital content, or representations that are intended to deceive.

This practice leverages the advanced capabilities of AI to replicate, imitate, or generate items that are indistinguishable from the original or genuine articles. The concept of AI counterfeit encompasses several areas:

Deepfakes: Perhaps the most well-known form of AI counterfeiting, deepfakes involve using AI algorithms, especially deep learning, to create highly realistic and convincing fake videos and audio recordings. These deepfakes can mimic real people saying or doing things they never actually said or did.

Forgery of Documents: AI can be used to replicate or create counterfeit documents. With sophisticated analysis of style and technique, AI algorithms can generate forgeries that are challenging to distinguish from authentic items.

Digital Identity Theft and Fraud: AI can be used to mimic personal traits, such as handwriting, voice patterns, and facial characteristics, leading to identity theft and fraud in digital spaces.

Can you spot the real from the fake?

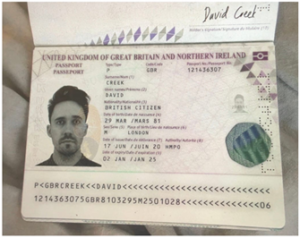

Below are two passports, can you spot which one is genuine?

In fact, both have been generated using AI.

Since Covid, businesses have implemented many non-face to face processes which are still in place today. Instead of customers showing you their documents which you can then make a copy of, they will instead send you scanned copies without you having to have met them in person.

So how can you verify they are genuine?

Check for inconsistencies: AI-generated documents may have inconsistencies in the layout, font, or alignment. Look for any irregularities in the text or images.

Inspect the photo quality: AI-generated photos might appear too perfect or lack natural variations seen in genuine ID photos. Look for signs of artificiality such as overly smooth skin, unrealistic lighting, or unnatural facial expressions.

Verify security features: Genuine passports and driving licenses often contain security features like holograms, watermarks, and special inks. Check for these features by tilting the document under light or examining it with a magnifying glass.

Examine the details: Look closely at the personal details such as the name, date of birth, and address. AI-generated documents may contain unrealistic or nonsensical information.

Compare with known samples: If possible, compare the document in question with genuine passports or driving licenses to identify any discrepancies in design or content.

Use technology: There are various online tools and software available that can help identify AI-generated images. You can use these tools to analyse the document for signs of artificial manipulation.

Seek professional assistance: If you have doubts about the authenticity of a document, seek assistance from experts such as law enforcement agencies or document verification services.

Some lenders will require you to have the documents verified by a professional such as the post office who provides this service, but just because the lender hasn’t asked for this, doesn’t mean you can’t ask for this yourself.

So, if you have any doubts, you can ask your customer for the original documents or for certified copies. No genuine customer will refuse to do this, when a customer does refuse to provide you with information, that is quite often a sign of fraud.

Where lenders are not asking for verified copies of documents, this may mean that they are verifying the customers’ ID electronically. This is a good way to help combat this type of fraud and why we use systems such as RedFlag which also verifies customers’ ID.

One last tip

If you are unsure if a document is genuine or not, ask Compliance. On many occasions we have had bank statements that looked like they may have been tampered with, which we reviewed ourselves and on cases where we were still unsure, asked the banks directly. They will then check the statements for us and let us know if anything has been amended.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.