Compliance has checked 500 cases so far this year, so what are the trends that we can learn from?

Last year we enhanced our file checking process and introduced some new initiatives:

- Phone calls to deliver file check feedback

- Heads up process to help new (BLUE) advisers with their learning journey

- Improved file checking scoring system

- Compliance 1-1’s

So far, our new approach has been well received and we have seen an increase in the amount of advisers achieving Competent Adviser Status (CAS). But as well as this we are seeing less repeat mistakes and a steady improvement in the overall file quality.

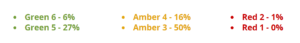

From the 500 cases, what scores do we typically see?

If you were not already aware, below is what the gradings mean:

- 6-Green Advice is suitable, and the file is complete with no missing documents or information.

- 5-Green Advice is suitable, but there are minor fact-find omissions or document omissions (not minimum standard documents) but the omissions are not affecting the advice.

- 4-Amber Advice is suitable, but some documents evidencing advice are missing, or the suitability letter is presented with minor omissions.

- 3-Amber Advice is suitable, but one or more company standard minimum documents are missing, or the suitability letter is presented to the customer with material omissions on the recommendation, requiring re-issue.

- 2-Red Unsuitable advice, eg. mortgage unaffordable, product does not suit customer needs, justification for the advice is not clear.

- 1-Red Suspected fraudulent case, e.g.Back door residential, staged income, fraudulent documentation etc.

So, the typical score we see files graded as is Amber 3, which 50% of the cases checked have been graded, this means that the advice is good, but the cases require some amendments or there are some missing documents. However, it is also worth noting that 33% of cases are graded Green, which shows that generally case quality is very good.

If you are unaware of what the minimum standard documents are, there is a process in the Operations Manual in BOX HERE

What trends do we see from file checks that are making cases Amber?

Missing documents is the biggest reason for seeing Amber cases, the main documents being:

- Incomplete or missing proof of deposit, especially with gifted deposits

- Sanctions Searches not being completed

- Missing Credit Reports

- Insufficient Proof of Income, such as missing payslips

- Fees being charged that are higher than Connect’s fees tariff. If you are unsure of what Connect’s fees tariff, you can read it HERE

We also see a number of Terms of Business (TOB) that are old versions. We will from time to time update documents within the Operations Manual; therefore, it is important that you refer to these in each case. We have recently updated our Terms of Business, so please ensure you are using the latest version.

The easiest way to pass a case is to use the File Check tab on the case, this will cover all of the documents and other requirements you need to pass a case.

Should you have any questions on this, please do not hesitate to contact myself or the compliance team.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk