We are delighted to announce that we are the only network and packager to offer this exclusive product New Refurbishment Term Loan.

We are delighted to announce that we are the only network and packager to offer this exclusive product New Refurbishment Term Loan.

Why this offer is different?

Before, if a client wanted a loan for refurbishment purposes, they would often need to apply for a bridging loan, which offered no guarantee of them being able to remortgage once the work had been completed, with a lender on the term and at the price they expected. This also meant the client would need to apply for two separate loans.

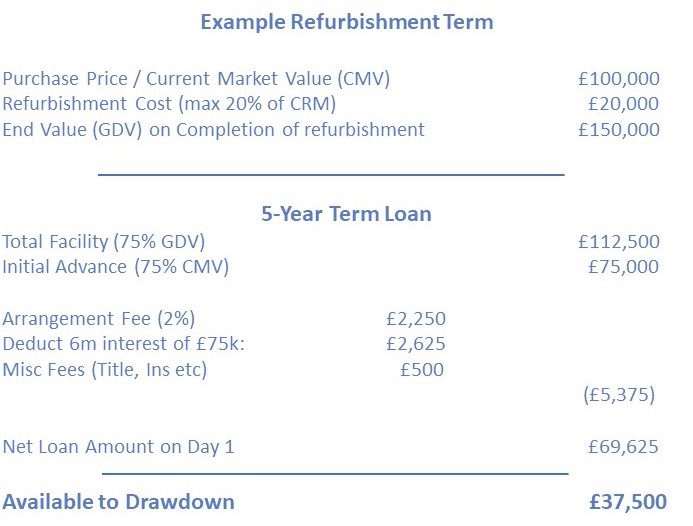

Now, with this new Refurbishment Term Loan, removes the risk and gives the client a 5-year term loan, on day one, based on refurbished property value. The lender holds back a portion of the loan and will release it once the work is complete and the property is occupied.

And there’s more

- The client only to pays for one set of legal fees, saving them time and money

- Speed, minimal documentation and streamlined processes help clients to secure loans quickly

- Similar offerings in the market will not consider the level of client or property complexity

- Removes the uncertainty and frustration of the client having to apply for a 2nd loan on completion of the refurbishment

Who will benefit

- Experienced Landlords who have owned a minimum of 3 BTLs in the previous 12 months

- Standard residential properties and HMOs/MUFBs (max 6 units)

- Additional security can be used to increase the loan amount

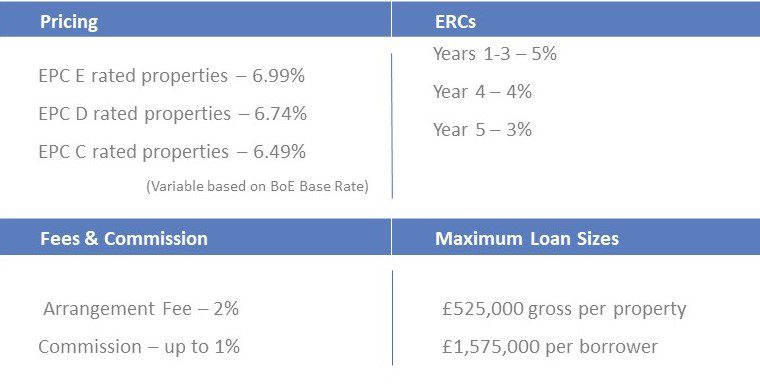

All you need to know