We are just a few weeks from the final implementation date for Consumer Duty.

Over the next few weeks, I will be sending you regular Consumer Duty emails, like this one, covering some of the updates the Network has made in readiness for meeting the Consumer Duty.

The Duty introduces new rules and guidance to ensure that:

- Products and services: are designed to meet the needs, characteristics and objectives of a specified target market

- Price and value: Products and services provide fair value with a reasonable relationship between the price consumers pay and the benefit they receive

- Consumer understanding: Firms communicate in a way that supports consumer understanding and equips consumers to make effective, timely and properly informed decisions

- Consumer support: Firms provide support that meets consumers’ needs throughout the life of the product or service

In this email, I will cover fees that you charge and how that impacts the Consumer Duty Price and Value requirement.

Fees And Fair Value

It is important to note The Duty applies to regulated mortgages. This includes regulated Buy to Let, such as Consumer and Family Buy to Let. However, as a regulated firm, we have also considered The Duty when creating our approach to the non-regulated products we offer consumers.

The Duty does not have a retrospective effect and does not apply to past actions by firms. However, the Duty applies, on a forward-looking basis, to firms’ ongoing work for existing customers.

The FCA confirms:

A mortgage intermediary must ensure that its own fees and charges offer fair value and that payment of these does not result in the product or service ceasing to be fair value overall. Firms should not exploit customers by, for example, charging unjustifiably or unreasonably high fees or charges to more vulnerable groups of customers such as those with a poor credit history or older customers.

Firms need to ensure they are providing consumers with the information they need to make informed choices and understand the costs involved. Firms should consider their fees and charges in the context of the Duty and consider what steps they may need to take. In particular, firms should review their services and pricing to satisfy themselves that they are offering their customers fair value.

The Connect Network Fee Policy

The work required under fair value sits with the Network creating a fair value framework, ensuring the services it provides and the products it distributes are fair value and that its distribution arrangements do not affect the overall fair value (for example, as a result of a broker fee).

We have collated and reviewed the fair value statements for the lenders and providers on the Network panel. We will be monitoring the lenders and providers on our panel to ensure that they meet the standards we expect to deliver good outcomes for our customers. We have also reviewed some of the fees that our Member Firms charge in light of the new rules and completed our own assessment of the fair value of fees using services typically offered by our Network Members.

Many of you offer complex and specialist advice and hold a level of lender and criteria knowledge that is higher than a typical mainstream-only mortgage adviser, which we wanted to consider when setting the Network fee policy. We are mindful of the FCA statement that firms should not exploit customers in more vulnerable groups, such as those with a poor credit history. However, we do feel that a higher level of expertise and a more detailed research and application process for complex cases does need to be recognised. (We will be communicating in due course additional work we are doing to identify and support vulnerable customers.)

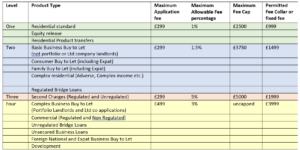

The Network has adopted a tiered approach in relation to fees. This policy specifies the Network’s maximum fee tolerances for different product types as per the table below:

We do not expect all advisers to charge the maximum, these are just the maximums allowed without the need for the Network Member to refer to compliance for pre-approval.

More details and a fuller explanation can be found in the full document in BOX here:

When we complete our Annual Fit and Proper assessment with each firm, moving forward, we will be asking you to outline your firm’s own fee-charging policy and how you believe your fees and services offer fair value to your customers.

To assist you in thinking about this, we have created some guidance and tools, which can also be found in BOX here:

If you need any further assistance, please do not hesitate to contact the Compliance team.

Kind Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk