With lenders being more and more risk adverse when it comes to evidence of income, it is important to ensure you are reviewing the documents and can identify potential issues and seek clarification before you proceed.

So, what are the most common areas we see on a payslip that could cause a lender concern?

- Net Pay. Does the net pay match what is being paid on the bank statement? This will almost never be different and if it is, you should ask for an explanation and evidence if available.

- Payment Method. Is the method of payment the same on the payslip as the bank statement? Payslips will confirm how they will be paid, i.e. BACs, CASH or Faster Payment and this should then match the bank statements. If this doesn’t the lender will almost certainly question this.

- Employee Number. Most payslips will have an employee number on them, this is usually given in order of when people joined the firm, so if someone has an employee number of 1, this will normally indicate they are the owner. A quick check can be to look at the employees start date and look at when the company was set up on Companies House. For example, if someone joins a company that has been in place for a number of years, their employee numbers will be quite high.

- Pension Contributions. Most people will have pension contributions included in their payslip, although, people can opt out of this. So, if you see this, ensure you are asking to a reason why.

- Consistency. Payslips will almost always look consistent between months, unless the company has changed software. Therefore, you should be looking out for differences between the payslips you have been given.

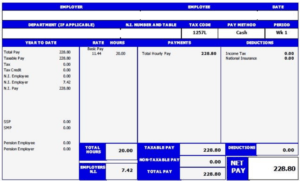

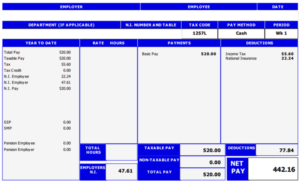

Look at the example below and see if you can spot anything that you would query?

Did you spot it?

Considering this is a payslip for the same company for the same week, they should match, but they don’t.

- In the Rate/ Hours section, one has the Basic Pay and number of hours, and the other is blank. Considering this is the same company, the two documents should be identical.

- In the payments section, one has the wording Total Hourly Pay and the other just has Basic Pay. If this wasn’t a joint application, this would be very difficult to spot, so you do have to pay close attention.

- The other issue with this, although you could not spot it, was the fact that the pay method for both was Cash, however, if you reviewed the bank statements, you could see they are paid via bank transfer.

These differences, without any explanation from the adviser, were enough for the lender to decline this case.

If you are ever unsure, you can always ask for copies of their tax documents from the Government Gateway which confirms the amount of tax and NI they pay per month, if this matches the payslips, this will help confirm the pay is genuine, but it isn’t a guarantee.

If you are ever unsure, you can always ask a member of the Compliance department who will be happy to help.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk