3 reasons to tell your BTL client about ERC-3

3 reasons to tell your BTL client about ERC-3

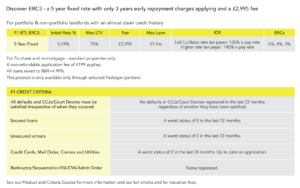

ERC-3 is a mortgage product which benefits from a 5-year fixed rate but only carries Early Repayment Charges for 3 years.

- The rate fixed for 5 years

A five-year fixed rate offers borrowers the security of knowing their mortgage payments won’t change in that time. Currently, 5-year fixed money is competitive, as the view for inflation and the Bank Base Rate is lower longer term.

- But the early repayment charges for only three years!

With many advisory firms seeing an increase in both remortgage and purchase demand from their landlord client base, we believe it’s important to provide product options that can deliver both payment certainty over a longer time-frame, but also an element of flexibility with the borrower able to look at their options in three years without having to pay an ERC.

- With the benefit of maximizing loan size from rental cover

Currently, 5-year pricing is competitive, plus with this being a five-year fix, it also means that landlord borrowers may be able to secure a higher loan amount, depending on their circumstances, with the ICR being based on the pay-rate. The product comes with an ICR based on the pay rate, available at 125% for limited company and basic-rate taxpayer borrowers and 145% for others.

Grant Hendry, Director of Sales comments

“We have offered these five-year fixes with three-year ERCs in the past and they have always been popular – we anticipate this product will be no different and are here to support advisers and their landlord clients with all their buy-to-let mortgage needs.”

To discuss your case call today 0344 770 8032