Good news – we’re now accepting CBILS applications for new customers.

Key features of our CBILS loans

- Loans between £50,001 and £350,000

- Nothing to pay for the first 12 months

- Loan terms of up five years

- 5.9% – 10.2% APR (excluding the interest the government pays the first 12 months)

- No personal guarantees on loans up to £250,000

- Repay early – either partially or in full – at any time

- 1% commission on funding amount – paid quarterly

For a handy overview, download a copy of our CBILS loan guide

Get Started

Get access to your portal

To submit CBILS applications, you need to accept our updated T&Cs (CBILS side agreement). You can request these here. Once accepted, we’ll unlock your introducer portal.

Submit your applications

You can now submit and manage CBILS applications directly through the introducer portal. Watch our explainer video to see the full process.

We’ll aim to get you a decision in 3 days

Applications are progressed to underwriting once we have all supporting documents. Check our document guide to make sure you have everything you need.

Draw down

We’ll send you a full offer for approved customers, with same day funding available.

Is your client eligible?

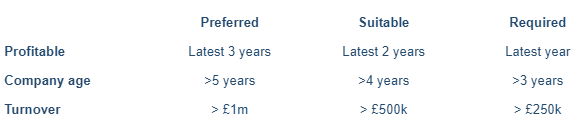

In addition to the BBB CBILS eligibility criteria, we want to help you sense check applications before you submit them to us. Customers meeting our ‘preferred’ criteria will have a greater chance of approval.

Still have questions?

Read our FAQs, or give us a call on 020 3434 3481.