Octopus updated Bridging and BTL Products

Octopus updated Bridging and BTL Products

Buy to let Term – Highlights:

- Support First-time landlords, First-time buyers, Foreign Nationals (on & offshore) and Ex-Pats.

- They can purchase/refinance a variety of asset types inc. HMOs, multi-unit freehold blocks, Semi-Commercial properties, Holiday Lets (no restrictions) and New Build assets.

- Able to defer interest.

- Min Loan £50k. Min property value £70k.

- No minimum income.

- AVM’s and Enhanced Indemnity Insurance can be used.

Bridging – Highlights:

Points to Note:

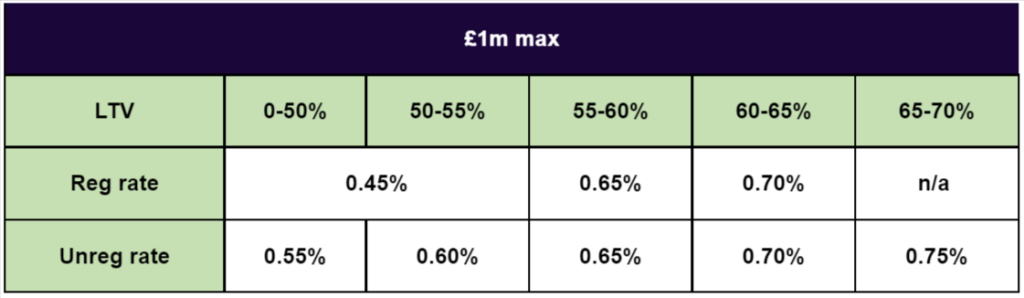

- Min loan size £100k. Max £1m.

- AVMS to be ran at AIP stage (70% for purchases, 55% for refinances).

- Fast Track option still available (see attached).

- Comfortable allowing clients to carry out light refurbishment projects while on a bridge, at their own expense, provided total budget is under £100k and the works are non-structural.

- Flexibility on security types – i.e., Semi-Commercial, HMO’s, multi-unit freehold blocks, unrestricted holiday lets.

- Support First time landlords, First time buyers, Foreign Nationals (on & offshore) and Ex-Pats.

If you have any questions or enquiries, please do not hesitate to reach on 07736 967355.