Clients could borrow even more with our improved loan to income multiples

Clients could borrow even more with our improved loan to income multiples

We’re improving our loan to income multiples (LTIs). This, together with our March affordability rate improvements, means we could help many more of your clients secure the mortgage amount they need.

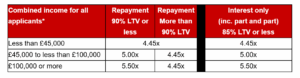

Plus, we’re simplifying our repayment and interest only LTI multiples and increasing our LTI multiples for loans up to and including 90% LTV for repayment mortgages.

How will this benefit your clients?

- 75-85% LTV – combined income of £100,000 or more could borrow an extra 10%.

- 85-90% LTV – combined income of £45,000 to less than £100,000 could borrow an extra 12%.

- 85-90% LTV – combined income of £100,000 or more could borrow an extra 24%.

Other lending criteria can also affect how much customers could borrow.

What are our new LTI multiples?

*Income may be a combination of primary and secondary income.

Use our affordability calculator on our website to find out how much your clients could borrow.

Help and support

julie.waterman@santander.co.uk

07545 699 325