Selina Finance updated the following products from 1st November 2022.

Selina Finance updated the following products from 1st November 2022.

On Tuesday, 1st November, they started accepting new enquiries and applications on their variable rate Home Equity Line of Credit (HELOC) via the Advice+ channel.

Selina will offer a variable-rate HELOC that is accessible to individuals/business owners, who are pleased to confirm that they have significantly reduced interest rates.

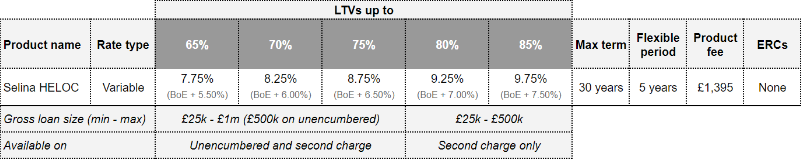

Please see the product matrix below – the new product guide is attached.

Product Matrix

Product Summary:

- LTV up to 85% and variable rates of 7.75% – 9.75%

- Introducers are able to charge up to 1.5% as a referral fee

- The loan would now be in the name of a director for business purposes, as opposed to the business

- Secured on a primary residence or second home (no BTLs)

- No early repayment, overpayment or non-utilisation or legal charges

- Income multiples of 4.49x for 1st charges, and 6x for a 2nd charge (business net profit can also be used in the affordability assessment)

- Product fee £1,395 (can be added to the loan)

- A multi-purpose facility that can be used for a wide variety of business purposes

- Minimum property ownership 6 months

- Minimum property value £100,000

- Minimum age 25 years (start of term) – maximum age 75 years (end of term)

What are the next steps to take?

- Complete the due diligence form to register for the Advice Plus channel: Advice Plus due diligence form

- Once you are fully registered, you can use the following link to submit a new referral: Submit a new Advice Plus referral

If you have any questions, then please drop an email or call on 020 3984 7721.