As you are aware, the impact of the pandemic on the market was widely felt across the lending landscape, leading some to withdraw from the market altogether, and others to tighten their belts. We were pleased to fall into the latter category, only making temporary adjustments to ensure we could continue to support our brokers as much as possible throughout this challenging time.

But as we gradually move forward and return to some sense of normality, our focus is on gathering momentum and helping you take advantage of the opportunities that are out there.

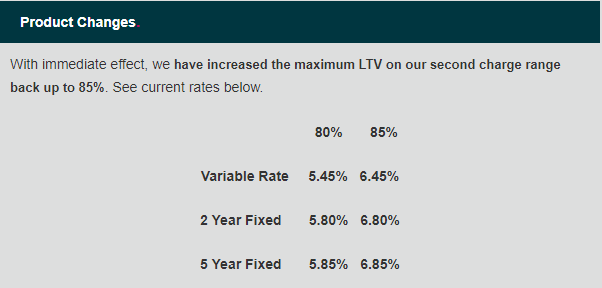

Which is why, today, we are delighted to announce that we have relaxed our criteria in several areas to pre-Covid levels.

Please find full details of the suite of positive changes we have made to our Products below!

The minimum loan amount is now £5,000 for LTVs between 75.01% and 85%.

Please note, we have increased our Lender Fee to £395. We will honour all existing applications entered with the previous lender fee of £300, providing the cases complete by Monday 7th September 2020.

Please be aware, currently we are only using basic income, for full details see our Criteria Guide.

You can download our updated Prime

Product Guide and Second Charge Criteria Guide by clicking the links below.