![]() YBS Commercial Mortgages have some good news. To support commercial investors and those rebuilding their businesses following the pandemic and the other economic challenges, we’re reversing some of the measures we put in place during that time. We’ve also taken the opportunity to review other limitations we had in place, such as the £3 million restriction on lending on properties with solely retail rental income.

YBS Commercial Mortgages have some good news. To support commercial investors and those rebuilding their businesses following the pandemic and the other economic challenges, we’re reversing some of the measures we put in place during that time. We’ve also taken the opportunity to review other limitations we had in place, such as the £3 million restriction on lending on properties with solely retail rental income.

What’s changing?

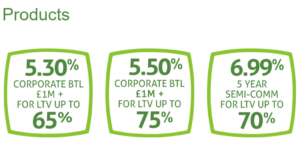

- From today we’re standardising lending on all commercial investment properties let out to a tenant, either entirely or partly for commercial reasons, regardless of sector

- Our maximum loan of £3 million per property up to 65% LTV will now be £5 million per property up to 75% LTV, with a total portfolio limit of £20 million, and is applicable to all businesses

- We’re also removing other limitations unrelated to the pandemic, such as the £3 million restriction on lending on properties with solely retail rental income (lending now available up to £5 million); and the removal of the requirement for a retail property to be 15 thousand square feet or less in size to be considered for a commercial loan.

We hope removing unnecessary complexity will improve the borrowing experience for brokers and clients alike, and provide much needed support for the commercial investment market.

|