Product Description

Product Description

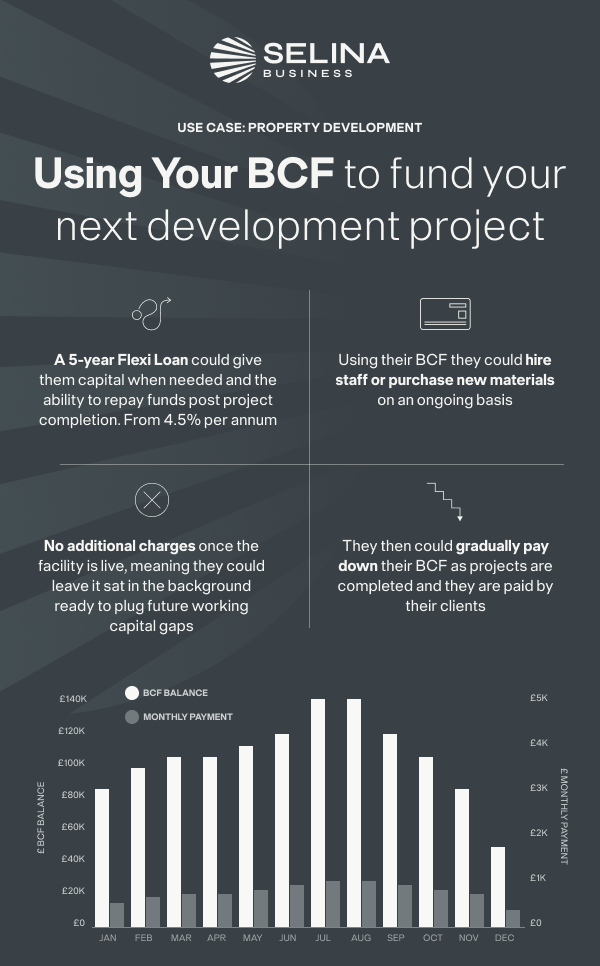

Selina’s Business Credit Facility (‘BCF’) is a flexible secured loan for businesses. It is secured on residential property, either the main residence or an investment property owned by the applicant (the business owner).

The BCF comes with a term of 5-30 years, allowing business borrowers to spread the repayments of the loan over a much longer period than a typical business loan.

The first 5 years of the BCF is structured as a flexible loan which allows business borrowers to flex their loan balance up and

down within their credit limit (see below).

Flexible period – first 5 years

Draw funds as required within the credit limit. Repay (and redraw) funds as required at any time.

After year 5, the balance converts into a standard term loan (the “residual loan”) which is paid off on a full repayment basis until the end of term or when the loan is refinanced.

Monthly repayments

Monthly repayments are calculated on the drawn funds, meaning the borrower only pays interest on the funds in use. No nonutilisation fees for the undrawn balance.

Why choose Selina?

-

- Secured against a residential property 1st, 2nd or 3rd charge

- Uncapped broker commissions

- Use it as a Flexible Loan (overdraft-type facility) or a term loan

- A maximum loan term of 30 Years

- Max 75% LTV

- No early repayment charges or Legal fees

- Used for any business purpose (incl. MBO/MBI)

- Indicative offers within minutes

See how Selina has helped their clients: