40% of the of the BTL deals we have completed in the last three months have been to foreign nationals or expats.

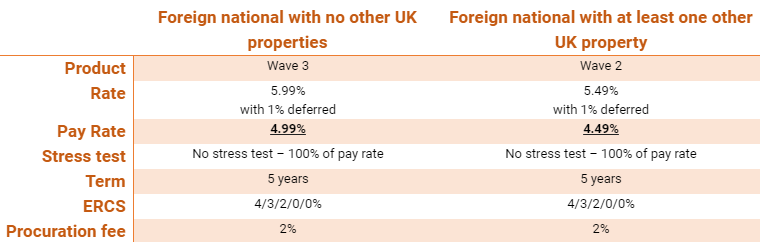

I know these cases can be tricky to place, so I thought it would be worth outlining how our rates work for this type of borrower:

A few points worth noting:

- We lend throughout mainland England.

- Our minimum loan for BTL is £150,000.

- We have no off-limits countries of origin/residence.

- The borrower does not need to have any credit footprint in the UK whatsoever.

- First time buyers/landlords are fine.

Our BTL product is designed to be able to help with a whole range of non-mainstream cases. As well as foreign nationals/expats we can help with:

- First time buyers/landlords.

- Adverse credit.

- Low income/no income.

- Semi-commercial properties.

- Residential above commercial.

- HMOs.

- Multi-unit freehold blocks.

And much more!

If you have any BTL, bridging, refurbishment or developer exit cases that you would like to discuss please do let me know.

Josh Knight

Senior Business Development Manager

t: 0345 222 9009 m: 07741 591 922