Here’s what Octopus have to say:

Here’s what Octopus have to say:

Just wanted to update that we have made a two big changes: The first, we are now able to incorporate second charges on our regulated product WITHOUT adjusting the rate or adding additional costs.

This will assist applicants who need that little be extra to get to the PP (or raise as much as possible) allowing them to use AVM’s and Enhanced Indemnity also!

This makes us market leaders across both regulated and unregulated products, we should be seeing every one of these deals moving forward.

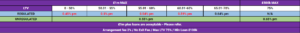

Below is the bridging product card with effected LTVs/rates highlighted in red:

Notes:

- If we are taking a second charge (with a first) the max LTV is 65%.

- AVMs can be used on both securities up to 65% LTV (including the remaining first charge). If the deal is a standalone first charge refinance we can only go up to 55% on an AVM

- We still continue to go to 70% LTV but on a first charge basis only.

- The max loan is 500k when using a second charge, reason we have don’t this is to utilise the Fast Track process as much as possible (AVM’s / Enhanced Indemnity)

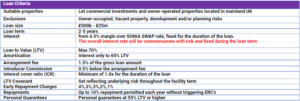

Secondly, we are back in the Commercial Term Market!

Commercial Term

Highlight of our other products below:

Buy to Let

We have relaunched our BTL offering earlier this year with great USPs versus our competitors

- No minimum income

- Foreign nationals/ex-pats/First time buyers/First time landlords all accepted

- Semi-commercial/HMOs/MUFB/Holiday Lets properties all accepted

- I’ve included our product matrix as a PDF as it goes into further detail on eligibility.

Unregulated Bridging

- We’re really targeting loans up to £1m at the moment, at aggressive pricing and capacity to reach 75% LTV on £500k bridges.

- We are comfortable allowing clients to carry out light refurbishment projects while on a bridge, at their own expense, provided total budget is under £100k and the works are non-structural.

- Flexibility on security types – i.e. Semi Commercial, HMO, flats, unrestricted holiday lets

- Complex company structures, foreign nationals, expats and adverse can be considered.

- AVM’s + Enhanced indemnity available.

- Commercial Bridging

- Experienced in-house lending team includes qualified Chartered Surveyors who have decades of investment experience.

- Flexible on security types such as Office/retail units, Petrol stations, Student accommodation, Industrial units, land with planning, vacant assets etc.

- First time commercial landlords.

- Lend in England and Scotland.

Any questions, email Oliver.Porter@octopus-