Compliance Updates

All the latest updates from Connect’s Compliance department can be found here. If you’re on a PC, you can bookmark this page by hitting CTRL-D

LATEST UPDATE:

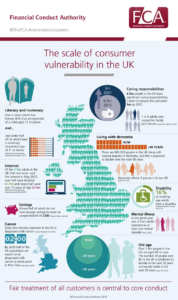

A vulnerable customer is someone who, due to personal circumstances, is especially susceptible to harm when engaging with financial services. The FCA expects firms to identify, understand, and appropriately support such customers to ensure fair treatment and good outcomes.

For further help and detail on how we can all work together to ensure customers receive all the help they need, please also take a look at the ‘Working together to support our vulnerable customers’ guide put together by Aldermore.

Should you have any questions, please contact the Compliance team who will be happy to help.

Common drivers of vulnerability include

Health – physical or mental illness, disability, addiction.

Life Events – bereavement, job loss, relationship breakdown.

Resilience – low savings, over-indebtedness, financial stress.

Capability – low financial literacy, poor digital skills, language barriers.

Why It Matters

Meeting FCA Consumer Duty and Treating Customers Fairly requirements.

Ensuring decisions are in the best interests of clients.

Building trust and long-term relationships.

The TEXAS Model

The TEXAS model is a structured approach to dealing with disclosures of vulnerability. It helps advisers respond consistently, empathetically, and compliantly.

- T – Thank | Thank the customer for sharing. Acknowledge their situation and show empathy. Example: “Thank you for letting me know, I appreciate you sharing this with me.”

- E – Explain – Explain why you need the information and how it will help you provide the right support. Example: “This will help me make sure we give you the right advice and avoid anything that might cause difficulties

- X – eXplicit Consent – Get clear consent before recording or sharing any sensitive information. Example: “Is it okay if I note this down so we can make sure we take it into account?”

- A – Ask – Ask about the impact of the vulnerability on their financial situation and preferences. Example: “Would you like us to adapt how we communicate with you, for example, by email instead of phone?”

- S – Signpost – Offer additional help, either within your firm or to external specialist organisations. Example: “If you’d like, I can point you towards support services that may be able to help further.”

For further help and detail on how we can all work together to ensure customers receive all the help they need, please also take a look at the ‘Working together to support our vulnerable customers’ guide put together by Aldermore.

Should you have any questions, please contact the Compliance team who will be happy to help.

Regards

Alan Baldwin

Director of Compliance & Operations

For any questions or queries regarding this email, please contact Member Support Team: membersupport@connectmortgages.co.uk

The next batch of emails will shortly be going to your completed mortgage customers from Elevation. As a reminder, these emails will be as if you had sent them, but will be sent automatically for you from the Elevation system.

You should by now have received your login details directly from Elevation, and you will receive an email whenever a customer completes feedback so you can review it.

Reminder: Consumer Duty Requirements

As a reminder, Consumer Duty requirements mean all Networks need to ensure they are able to measure that the advisers they supervise are meeting the new requirements of the Duty. As previously communicated, Consumer Duty means we need to provide actual evidence that shows we are putting customers at the heart of the business. Many advisers do have review facilities such as Trust Pilot or Google reviews. However, the FCA has indicated that a good review does not in itself satisfy their requirements in evidencing that good consumer outcomes have been delivered.

Why Elevation?

Some networks have chosen to telephone customers and ask questions to obtain this evidence. We have chosen Elevation as we believe it is also a great tool for our members. Elevation by VouchedFor is different from a normal review service in that it asks a range of questions to fully understand the customer’s experience. The information from this gives both the network and the adviser the ability to understand the journey from the client’s perspective, as well as evidence the good outcomes or learn where improvements can be made.The insights the adviser gains can increase conversions, business levels, and personal recommendations.

Feedback Request Email

The feedback request email sent to your customer by the Elevation system is addressed from you because your customer knows you. This means a higher response rate. To maximise the benefits, it’s a good idea to let your customer know that they will receive it. We are currently scheduling requests for completed mortgages, but in due course, we will schedule requests at earlier stages in the process. This is incredibly powerful, as it will provide you with insights on why some customers do not proceed with an application.

All advisers have access to a free account with Elevation to see their feedback. There is also an option to have a personal VouchedFor profile to display the customer rating part of the Elevation feedback at a discount to the normal price. This is similar to services like Trust Pilot and Google Reviews but can also help you with lead generation through their free ‘find an adviser‘ service.

If you would like any further information, please reach out to the Member Support Team in the first instance.

Regards

Alan Baldwin

Director of Compliance & Operations

For any questions or queries regarding this email, please contact Member Support Team: membersupport@connectmortgages.co.uk

For any questions or queries, contact the Compliance Team Call : 01708 676110 Email : compliance@connectmortgages.co.uk

When communicating with clients, please be mindful that including personal data in standard emails (such as names, addresses, DOBs, mortgage details, or account numbers) carries security risks. Unencrypted email can be intercepted, misdelivered, or accessed if an account is compromised, potentially leading to a GDPR breach.

When communicating with clients, please be mindful that including personal data in standard emails (such as names, addresses, DOBs, mortgage details, or account numbers) carries security risks. Unencrypted email can be intercepted, misdelivered, or accessed if an account is compromised, potentially leading to a GDPR breach.

It is fine to send general market updates, confirm appointments and also use their name, providing there are no other personal identifiers.

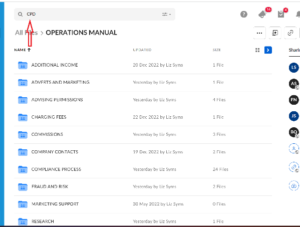

Wherever possible, encourage clients to use the OMS client portal. Your clients can safely send secure documents to you this way and can read any updates you make visible in a secure way.

If email must be used, you should ensure files are encrypted before sending.

Having completed our due diligence process we are happy to recommend Mailock from Beyond Encryption as the preferred solution.

Why This Matters

As a regulated firm, you’re required to ensure that any communication containing personal, sensitive, or financial data is protected. Secure email is a practical step toward fulfilling your obligations.

We have assessed Mailock against key compliance, usability, and integration criteria. The platform:

- Encrypts emails and attachments, protecting client data in transit.

- Allows you to verify recipients’ identities before granting access.

- Provides a full audit trail, helping to demonstrate your compliance efforts.

- Can be used with Outlook and your web browser, making it easy to adopt.

- Enables clients to respond securely without creating an account.

Mailock is already in use across many firms in the industry, and it has been recognised for its focus on regulatory compliance and client experience.

How to Get Started

We have secured a Connect Mortgages Member price of £8.50 per user/month, making it both a compliant and cost-effective choice.

This rate has been negotiated on your behalf, but each firm will contract directly with Beyond Encryption the providers of Mailock.

To take advantage of this offer or learn more, please click below:

Connect Mortgages Mailock Trial Registration

Alternatively, join a live Webinar and see Mailock in action:

Join a 30-minute webinar hosted by Carole Howard from Beyond Encryption on 2nd September at 11:00 am to see how Mailock works in practice and ask your questions live:

Register for the Mailock Webinar 02.09.25

For any further information: Carol Howard, Beyond Encryption Carole.Howard@beyondencryption.com

+44 20 8123 4546 | 07929750654

Regards

Alan Baldwin

Director of Compliance & Operations

For any questions or queries, contact the Compliance Team

Call : 01708 676110

We have updated the DYA process to provide greater flexibility for advisers.

Key Changes

- Experienced Adviser Approval: Any adviser who is considered experienced will now be eligible for DYA approval.

- Tenure-Based Eligibility: Advisers who have been with the network for more than two years may also be eligible, but this will be dependant on a review by compliance.

- No Automatic Approval: DYA approval is not granted automatically. Advisers must request it.

Training Requirement – Mandatory Before Applying

Before you can be granted DYA approval, you must complete the Do Your Own DIPs and Applications course on the LMS.

Once completed, email Compliance to confirm completion and request your OMS permissions be updated.

Request Process

- Complete the Do Your Own DIPs and Applications LMS course.

- Email Compliance to request DYA approval.

- Compliance will review your eligibility and, if approved, update your OMS permissions.

Case Management Option Still Available

Even if you qualify for DYA, the Case Management Team remains available for any adviser who prefers to have a large percentage of their work handled by the team.

Benefits remain for just £99 per case – including reduced admin workload, support with lender requirements, and quicker case progression.

Action Required

If you meet the above criteria, complete the LMS course, and wish to manage your own DIPs and applications, please email Compliance to request DYA approval.

For more information please review the Experienced Adviser DYA Process in the Operations Manual.

Regards

Alan Baldwin

Director of Compliance & Operations

or any questions or queries, contact the Compliance Team

Call : 01708 676110

Staged Income – What Mortgage Advisers Need to Know

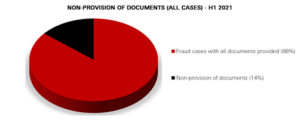

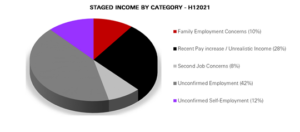

In recent months, we have seen a marked increase in lender warnings issued to mortgage advisers regarding staged income cases, as well as instances of advisers being removed from lender panels. While panel removal can sound serious, it’s important to recognise that these situations are almost never due to advisers deliberately committing fraud. Instead, the primary cause is a lack of due diligence during the application process.

What is staged income?

Staged income occurs when an applicant’s earnings are artificially increased—often temporarily—before a mortgage application is submitted, to make affordability appear stronger than it truly is. This may happen through salary uplifts, additional bonuses, or overtime that does not reflect the applicant’s genuine, sustainable income.

Why does it matter?

Lenders view staged income as a significant red flag for mortgage fraud risk. Even if the adviser had no involvement in manipulating income, failing to identify or question suspicious changes can lead to loss of lender trust and removal from panels.

Red Flags to Watch For

When reviewing a case, consider whether any of the following apply:

- Unusual commute – Does the client live far away from their stated workplace without a clear reason?

- Dual full-time roles – Do they claim to have two full-time jobs, raising questions about plausibility?

- Recent pay rise – Have they received a salary increase shortly before the application?

- New employment – Have they only recently started a new job, especially if combined with a significant pay uplift?

- Income inconsistencies – Are there discrepancies between bank statements and payslips?

- Reluctance to provide documents – Are they hesitant or slow to supply financial evidence?

- Multiple adviser approaches – Have they already spoken to other advisers before coming to you?

What can mortgage advisers do to combat staged income?

- Scrutinise income patterns – Review payslips, bank statements, and employment histories for sudden, unexplained changes.

- Ask the right questions – Seek written confirmation from employers for recent changes in pay, including whether they’re permanent.

- Document everything – Keep clear notes of your due diligence to evidence your checks if questioned.

- Challenge inconsistencies early – Address anything suspicious before submission.

- Stay updated on lender guidance – Understand each lender’s criteria for acceptable income changes.

- Speak to compliance before submitting – If you have concerns, discuss the case with the Compliance team before submission. They can advise on whether the case should proceed and what additional due diligence may be required.

- Pass documentation to the lender – If you or Compliance have requested extra documents—such as employment contracts, tax documents, or other verification—ensure these are also given to the lender with the application. If a lender thinks you haven’t carried out sufficient due diligence, they may assume you are either complicit or lacking in skill—neither of which is good for your professional reputation. Make sure the lender can clearly see that you have followed the Know Your Customer (KYC) process and completed thorough checks.

Final thought:

With lenders increasingly vigilant, the onus is on advisers to spot, question, document, and share evidence of due diligence. Protecting your place on a lender panel is not just about avoiding fraud, it’s about proving to lenders that you act with skill, care, and diligence on every case.

Regards

Alan Baldwin

Director of Compliance & Operations

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

In the mortgage and equity release market, particularly where one party provides security for another’s borrowing, legal safeguards are essential to prevent exploitation or abuse. A central concern in these transactions is undue influence, where one person uses their position of power to persuade another to enter into a financial agreement against their best interest. This issue is especially critical in cases involving spouses, elderly individuals, or those with limited financial knowledge.

To address these risks, the courts have developed a legal framework, most notably through the Etridge Protocol, to protect vulnerable individuals. Recent case law, including the 2025 Supreme Court ruling in Waller-Edwards v OneSavings Bank (OSB), has refined these protections, especially in the context of complex or “hybrid” mortgage arrangements.

What is Undue Influence?

Undue influence arises when one party exerts improper pressure on another, overriding their free will in entering into a contract. In financial services, this can occur when a person agrees to take out a mortgage or act as guarantor under emotional or psychological pressure, often in domestic or family settings.

The courts classify undue influence in two categories:

- Actual undue influence – where there is clear evidence of coercion or manipulation.

- Presumed undue influence – where the nature of the relationship gives rise to concern, and the onus is on the dominant party or lender to rebut that presumption.

The Etridge Protocol

The leading authority on undue influence in mortgage transactions is the House of Lords decision in Royal Bank of Scotland v Etridge (No. 2) [2001]. This landmark case introduced a formal protocol that lenders and solicitors must follow to protect individuals acting as sureties, particularly where:

- The transaction appears not to benefit the person offering security (e.g. a wife guaranteeing her husband’s business loan).

- There is a close personal relationship that might give rise to presumed undue influence.

Key duties under the Etridge Protocol:

- Lender’s Responsibilities:

- Must be alert to situations where undue influence might exist (“put on inquiry”).

- Must ensure the borrower receives independent legal advice.

- Should not proceed unless the solicitor confirms advice was given in a separate, face-to-face meeting.

- Solicitor’s Duties:

- Must confirm that advice was independent and informed.

- Should explain the nature and implications of the transaction, including risks to property and legal rights.

- Must be alert to any signs of coercion or misunderstanding.

This process is especially important in equity release transactions involving older homeowners, who may be more vulnerable to pressure from family members or others seeking to access their property wealth.

Recent Development: Waller-Edwards v OneSavings Bank (2025)

In Waller-Edwards v OneSavings Bank, the Supreme Court revisited the application of the Etridge Protocol to so-called hybrid mortgage arrangements, where part of a loan is for joint benefit (e.g. home improvements) and part benefits only one party (e.g. personal debts or business interests).

The Court ruled that:

- Where any more-than-trivial portion of the loan does not benefit both parties, the lender is “put on inquiry” and must comply with the full Etridge requirements.

- This applies even if the borrower contributes to joint household finances or has partially repaid the loan.

This judgment provides a clear bright-line test for lenders: if there is any separate benefit to one party, no matter how small, Etridge protections must be applied. The case highlights the ongoing relevance of undue influence protections in modern mortgage lending, particularly in mixed-purpose loans or equity release scenarios involving family dynamics.

Implications for Equity Release

Equity release schemes, such as lifetime mortgages, can be complex and emotionally charged. Older homeowners may be encouraged to release equity by family members who benefit from the proceeds. These arrangements can involve:

- Transfers of money to children or grandchildren.

- Repaying debts held only by one partner.

- Securing lending where mental capacity may be in question.

In such cases, the Etridge Protocol and the Waller-Edwards ruling make clear that legal advice must be thorough, independent, and properly documented, with special care taken when the transaction is not obviously for the homeowner’s direct benefit.

Tips for Mortgage Advisers: Spotting and Preventing Undue Influence

Mortgage advisers are often on the front line and are well-placed to detect red flags early. Here are practical steps to identify and avoid undue influence:

Watch for Red Flags:

- The client appears passive, confused, or overly reliant on another person to answer questions.

- The other party does most of the talking, especially during suitability discussions.

- The loan purpose primarily benefits someone other than the applicant.

- The client seems rushed, pressured, or uncomfortable.

- There’s resistance to the client receiving independent legal advice.

Create a Safe, Private Environment:

- Where possible, ensure the client is seen alone, at least once during the advice process.

- Reassure them that they can ask questions or walk away without any obligation.

- Clarify their right to independent legal advice and why it’s in their best interest.

Clearly Document Everything:

- Note down all conversations, especially if anything felt unusual or if concerns were raised.

- Record that the client understood the risks, especially loss of property or long-term debt obligations.

- Confirm that recommendations were based on their best interests, not someone else’s.

Know When to Escalate:

- If you have concerns that the client is under pressure, pause the application and escalate to compliance or management.

- Do not proceed if you are not satisfied that the client is acting freely and with full understanding.

Conclusion

The principles of undue influence, as developed through the Etridge Protocol and affirmed in Waller-Edwards v OSB, are vital safeguards in mortgage and equity release transactions. These legal protections ensure that individuals, particularly those in close personal relationships or with less financial expertise, enter into financial arrangements freely, knowingly, and without improper pressure.

While the ruling primarily focuses on lenders, the increased scrutiny on borrowers and their circumstances will likely extend to brokers, who are often involved in the initial stages of mortgage applications.

Regards

Alan Baldwin

Director of Compliance & Operations

For any questions or queries, contact the Compliance Team

Call : 01708 676110

The Financial Conduct Authority (FCA) has launched a market study into the distribution of pure protection insurance products to retail consumers. The aim is to evaluate whether the market operates effectively and delivers fair outcomes for consumers.

You can read the full report HERE

Scope of the Study

The FCA’s review will focus on four core product areas:

- Term Assurance

- Critical Illness Cover

- Income Protection

- Whole of Life Insurance, including guaranteed acceptance plans for individuals over 50

Key Areas of Concern

The FCA has identified several concerns prompting this study:

- Commission Structures: Concerns that commission arrangements may incentivise intermediaries to recommend products that do not represent fair value to consumers.

- Product Value: Cases where total premiums paid significantly exceed potential payouts, raising concerns about the true value of the product.

- Market Competition: A reduction in the number of insurers in the market may have diminished competition, impacting consumer choice, pricing, and product quality.

- Consumer Understanding: The FCA is examining how well consumers understand the products they purchase and whether they are making well-informed decisions.

Consumer Duty

The introduction of Consumer Duty has placed increased emphasis on the fair and appropriate sale of protection products. Advisers must ensure that products provide fair value and genuinely meet customer needs.

One specific area of concern raised by the FCA is the sale of products on a commission basis, particularly where this incentivises recommendations that do not align with the customer’s best interests. The FCA has cited examples where clients have been encouraged to switch products unnecessarily—often to ones that offer reduced value or suitability.

Ensuring Your Advice Is in the Customer’s Best Interest

Connect offers access to a broad panel of providers, enabling advisers to recommend products that meet customer needs and deliver good value. To safeguard both the customer and the adviser, it’s essential to ensure your recommendations are well-documented and justifiable. If advising a customer to switch products, consider the following:

- Record Your Calls: If a complaint arises, Connect must be able to evidence what was discussed. Unrecorded calls may limit our ability to defend your advice.

- Evidence Policy Reviews: Ideally, upload the customer’s existing policy documents. Alternatively, provide a detailed summary of their current cover—outlining what is included or excluded—and ensure this is reflected in both the fact find and the suitability letter.

- Use Comparative Tools: Utilise systems that compare existing and proposed policies. This helps demonstrate that the new recommendation offers a tangible benefit—not just in terms of cost, but in overall suitability and value.

Final Thoughts

The sale of protection products remains a vital part of the advice process. Ensuring customers are fully protected is a key component of meeting Consumer Duty obligations. We are committed to supporting our Network in delivering advice that serves the best interests of clients—and can be clearly evidenced should any issues arise in the future.

If you have any questions, please do not hesitate to contact the Compliance Team. We are here to help.

Regards

Alan Baldwin

Director of Compliance & Operations

For any questions or queries, contact the Compliance Team

Call : 01708 676110

We want to bring to your attention the ongoing scrutiny by lenders regarding what they determine to be fair and reasonable levels for broker fees. Initially, this focus was placed on residential mortgages, which led to a reduction in our network’s fee tolerance for residential transactions. However, lenders are now extending their review to include fees charged on Buy-to-Let (BTL) mortgages, including non-regulated loans.

Currently, we are actively engaging with our panel of lenders to understand their expectations regarding acceptable broker fees. One notable example is Coventry Building Society, including its subsidiary Godiva, which has implemented a broker fee cap of 1% of the loan amount or £1,250—whichever is lower—across all their products. However, other lenders have the same fee tolerances which is why we are currently in discussions with them.

Be Mindful of These Developments

It is crucial for all our ARs to be mindful of these developments to avoid any potential issues with lenders. In extreme cases, failure to comply with lender expectations could result in case cancellations or even removal from lender panels.

We want to emphasise that brokers should always select lenders based on what is best for their clients and not make decisions based on fee restrictions. Understanding market expectations and setting broker fees accordingly will help ensure smooth transactions and continued positive relationships with lenders.

Current Status

At present, Connect has not revised its allowable broker fee structure. However, we are actively reviewing this matter, and should any changes be implemented, we will communicate them in advance.

Please ensure that you remain aware of these market expectations and adjust your practices where necessary. If you have any questions or concerns, do not hesitate to reach out to the Compliance Team.

Regards

Alan Baldwin

Director of Compliance & Operations

For any questions or queries, contact the Compliance Team

Call : 01708 676110

he Financial Conduct Authority (FCA) expects principal firms to exercise effective oversight and supervision of their appointed representatives (ARs) to ensure compliance with regulatory requirements and prevent harm to consumers and markets. Key expectations include:

- Pre-Appointment Due Diligence – Principals must conduct thorough checks before appointing an AR, assessing its financial stability, business model, and the competence of its senior management.

- Ongoing Monitoring – Principals must regularly review their ARs’ activities, ensuring they remain compliant with FCA rules. This includes risk assessments, audits, and scrutiny of financial promotions.

- Clear Responsibilities & Controls – Principals must set out clear policies, training, and procedures for ARs, ensuring that they act within their scope of permissions.

- Data & Reporting – Principals must collect and analyse relevant data on their ARs’ performance and compliance, reporting key issues to the FCA when necessary.

- Intervention & Termination – Where issues arise, principals should take swift action to address concerns, which may include terminating the AR arrangement if necessary.

Effective controls and continuous adviser monitoring are at the core of our Network’s regulatory requirements. A dedicated Compliance department is essential to ensure the quality and performance of our Authorised Representatives (ARs).

While regular file reviews, grading, annual observations, and Fit & Proper assessments might be challenging, they are crucial for demonstrating ongoing competence and achieving the best customer outcomes.

In addition to these measures, the FCA mandates that Networks promptly address any breaches and report them. Although this aspect of the process is not always welcome, strict adherence to FCA guidelines is non-negotiable.

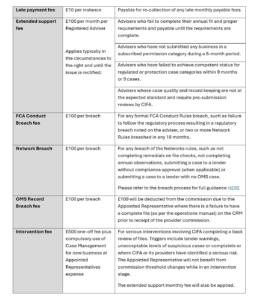

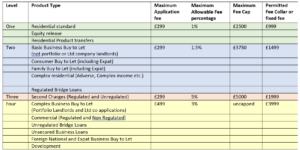

To ensure clarity about the rules and the consequences of non-compliance, below is a list of the fees that may be applied. The most effective way to avoid these fees is to consistently follow the guidelines.

These fees are as follows:

If you have any questions about any of the above, please do not hesitate to contact the Compliance team, who will be happy to help: compliance@connectmortgages.co.uk

Regards

Alan Baldwin

Director of Compliance & Operations

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

Anytime an Appointed Representative (AR) joins Connect, they are given an FCA number, whether they conduct regulated activity or not. There are many advantages to this, which will benefit your business, your clients and us as a Network.

Benefits for a Mortgage Adviser

Legitimacy & Trust – Being an FCA authorised firm gives you credibility, showing clients that the adviser meets regulatory standards. To have an FCA number, an adviser must be assessed as Fit and Proper and continue to evidence these standards. The adviser must conduct some regulated activity in order to warrant their FCA number. The FCA has concerns of customers believing they are dealing with an authorised broker. However, the broker is conducting that business as a non-regulated broker

Access to a Wider market – Many lenders will only work with FCA-regulated advisers, expanding the range of mortgage products available to them even if the product is non-regulated.

Compliance with Industry Standards – Ensures the adviser follows ethical and professional standards, reducing the risk of misconduct.

Consumer Confidence – Clients feel more secure knowing the adviser is regulated and must act in their best interests.

Ombudsman Access – If disputes arise (from regulated products), clients can escalate complaints to the Financial Ombudsman Service (FOS) for a fair resolution.

Legal Protection – Advisers are required to follow FCA rules, which help safeguard both them and their clients from fraud or malpractice.

Protection for Clients

Fair Treatment – FCA-regulated advisers must adhere to the FCA’s Consumer Duty and Treating Customers Fairly (TCF) principles.

Transparent Advice – Advisers must disclose fees, commissions, and any potential conflicts of interest.

Redress & Compensation – If an adviser gives bad advice that causes financial loss, clients may claim compensation through the FSCS.

Regulatory Oversight – The FCA regularly monitors and can take action against advisers who breach rules, including fines or bans.

PI – The PI cover that Connect AR’s benefit from only covers business conducted under the FCA authorised business.

Why it is important that all business is conducted under your FCA authorised business?

Whilst most lenders will only accept business from FCA authorised brokers there are some that will take business from non-regulated brokers for non-regulated products such as bridging. However, as a Connect AR holding an FCA number, any business conducted outside would fall foul of the FCAs concern that the customer believes they are dealing with a FCA authorised broker and the benefits of such.

Whilst clients do not have the option of taking a complaint to the Financial Ombudsman Service (FOS) on non-regulated activity, they can still raise a complaint to the Network and take their complaint to the courts. For this reason, we still require all required documents to be on file, such as Terms of Business and Reasons Why Summaries, because without these, a complaint is very difficult to defend, likely meaning the complaint will go in the favour of the client and not the adviser. So, upholding these standards on non-regulated activity protects you, the adviser and us, the Network.

The risk for brokers conducting business outside of a FCA authorised business is that there is no protection, such as, no PI insurance, meaning that any redress from a complaint would mean that the adviser is personally liable.

Summary Actions

- Ensure you are meeting the requirements to maintain your FCA number

- Do not risk undertaking business outside of your FCA authorised business(s)

If you have any questions, please do not hesitate to contact the Compliance team, who will be happy to help: compliance@connectmortgages.co.uk

Regards

Alan Baldwin

Director of Compliance & Operations

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

Following feedback from advisers, we’re pleased to confirm that you can now send Terms of Business letters through DocuSign using OMS.

This new process brings several key advantages:

- Faster turnaround: Documents can be sent and signed quickly, reducing delays.

- Up-to-date documentation: The system ensures that the latest version of the Terms of Business is always used.

- Clear audit trail: There is a complete record of when the document was sent, received, and signed for compliance and accountability.

To be able to use this automated TOB, you will have first needed to have updated your fees in the loan details tab in OMS and put the case to the correct stage, full information on this is covered in the below training video.

To help you learn this new process, Member Support have prepared a training video that takes you through all the steps required to send your client a TOB via OMS. Click on Image below view.

Should you have any further questions, please do not hesitate to contact Member Support who will be happy to help. membersupport@connectmortgages.co.uk

Regards

Alan Baldwin

Director of Compliance & Operations

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

Whilst using the Case Management team to submit your cases works great for most advisers, there are occasions where firms may want to take on the responsibility for ensuring the DIPs and Applications are submitted accurately and the case quality is maintained.

Therefore, we have amended our process to allow certain Controllers or Advisers, to take on the responsibility for the quality of submissions for others within their firm.

There are, however, criteria that must be met and maintained for this approval to be granted, this is:

- The controller or supervising adviser must be CAS/ Green status for that product

- This process only applies to Residential & BTL cases.

- The adviser must still have the required permissions for the product being advised on.

- This process excludes Commercial, Development Finance and Bridging cases as there is a Commercial, Development Finance and, Bridging Expert process already in place.

- Even if a firm is given DYA approval, the normal file-checking process still applies. For example, BLUE advisers must still have their file checked by Compliance pre-application.

- We retain the right to remove DYA approval should any concerns be raised, such as (but not limited to):

- The controller or supervising adviser no longer has Green adviser status

- File quality does not meet Connect IFAs expectations

- Lender or internal concerns raised

- Complaints raised against the adviser or Controller/ Supervising adviser

With immediate effect, should any firm who meets the above criteria want their advisers to submit their own cases, this can be done so long as you request to Opt-In to this process, this can be done by contacting the Compliance Team and confirming who will be supervising the cases. The controller or nominated adviser will then be responsible for reviewing these cases and ensuring the quality of submissions meets the networks standard, otherwise DYA approval may be removed and again requiring cases to be processed via the Case Management department.

If, however, you want to submit via the packaged payment route, this would still require submission by the Case Management department.

This process can be found in the Operations Manual with links to all other relevant processes. A link to this process is also HERE

Regards

Alan Baldwin

Director of Compliance & Operations

For any questions or queries, contact the Compliance Team

Call : 01708 676110

As part of our ongoing commitment to regulatory compliance, we would like to bring your attention to the upcoming Annual Financial Data Request mandated by the Financial Conduct Authority (FCA). For those who have been affiliated with Connect for over a year, you will have received the same request last year.

The FCA requires the submission of this information on an annual basis, and it is now time to initiate the process once again. This data request will be directed to the controller of each firm, who is expected to complete it on behalf of the entire organisation.

We will require the following information:

- Email Address

- Firm Name

- Firm Reference Number (FRN)

- Revenue Generated by Non-Financial Non-Regulated Activity.

Non-Financial Non-Regulated Activity means any revenue generated by your firm that is not related to the advice on mortgages or protection, such as, fees received from the following, but not limited to:

- Solicitors

- Accountants

- Estate Agents

The revenue received should be for the period of 1st January 2024 until 31st December 2024.

If you have not received any revenue that is not from Regulated or Non-Regulated activity, please input £0 on the form as we will still require this information.

When does this need to be completed by?

We will be sending out the online forms to be completed in the next week or so, and we will require completion by 31st January 2025.

What if I have other companies or lines of work?

We are only required to report on the firm that is approved by the FCA and is part of the Connect Network, therefore, if you have revenue generated by other firms, this is not required to be included in this report.

If you have any questions or require help completing this request, please do not hesitate to speak to the Compliance team who will be happy to help.

Regards

Alan Baldwin

Director of Compliance & Operations

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

Since the launch of Consumer Duty by the FCA, all firms have been required to review their fees to ensure they represent fair value for the services provided. Rather than being a ‘one-and-done’ process, this is something all firms are required to do on a regular basis.

Last year, Halifax announced that they would be setting limits on broker fees that they would allow, these limits being 1% or £1,500 (whichever was higher). While no other lender has followed their example and confirmed their limits, we are aware that many lenders have similar expectations and will certainly not be expecting to see fees above 1%. We have also been advised that some lenders such as Coventry, have set internal limits or expectations of 1% of the loan amount to a maximum of £1,250 and this will likely be the cases for other high street lenders.

Therefore, we were required to take this information from lenders into consideration when reviewing our own fees policy, to ensure that our Network Members do not fall foul of these rules and risk having cases declined due to excessive fees.

Following this review, we have made some changes that we believe are in the best interest of the customers and remain consistent with what we and our lender panel believe are fair and reasonable.

We have therefore made the decision to remove the Complex Residential option from our policy which allowed advisers to charge up to 1.5% of the loan amount. Connect will now only allow a maximum broker fee of 1% for all residential mortgages, which includes Equity Release. We have, however, increased the maximum fee amount from £2,500 to £3,000 to reflect the increasing average house price in the UK.

Connect’s fees policy has been updated and can be found in the Operations Manual in BOX HERE

This change is effective immediately and must be used in all cases going forward, however any fees already agreed will be allowed to continue so long as the terms of business have already given to the customer and can be evidenced on OMS.

If you have any questions or would like to discuss this policy further, please do not hesitate to contact the Compliance Department.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

Due to FCA requirements, we have issued an addendum to the Appointed Representative contract to give clarity around the requirement for advisers to be noted on the FCA register before conducting any regulated mortgage or insurance business.

For ease and, for your reference, the only only amendment to the contract is highlighted below:

Additional Clause

or

2.3.4 be permitted to carry on (or purport to carry on) any Regulated Mortgage or Insurance activities until its Registered Advisers are included on the FCA register.

You can see more information HERE

As this is an FCA requirement, please note this additional clause is effective immediately.

Please contact the compliance team if you have any questions.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Since Connect launched the VouchedFor customer questionnaires, we have received a lot of information on what we are doing great as a Network, and what we can improve on.

One area I think we can improve on easily is communicating to customers how an adviser is paid, as this is the most raised point from customers.

From the questionnaires that have been completed so far in 2024, 28% of our customers stated that they do not know how their adviser is paid in relation to the mortgage or protection policies taken.

So, what can we do to improve this?

Firstly, there are a number of documents that customers are given that confirm exactly what advisers are paid in relation to the service they provide and the commission they will receive from the lender:

- Terms of Business

- ESIS

- Offer

As well as providing your customer with these documents, you should also be taking the time to carefully present these documents and ensuring your customer is happy and understands all the key points.

You could also talk to them after and ask them a few questions so you can be sure they understand the advice being given and fees involved, try asking them:

- Are you happy that you are on the best mortgage?

- Have I explained clearly all the fees you will incur?

- Are you aware of how I will be paid?

- Is there anything that you would like me to explain again?

Whilst all the key information is detailed within the documents you provide, it is also important to talk to your client and ensure that any questions they have about the mortgage have been answered.

Each year, every adviser completes an observation with the Compliance Department and will receive feedback on what went well and what could be improved on. If you ensure you have the same conversation with your customers, you can be confident that you are doing everything you can to ensure your customer is treated fairly and understands everything they should.

If you have any questions, please do not hesitate to contact a member of the Compliance Department or Member Support who will be happy to help.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

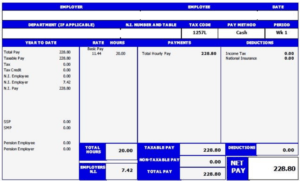

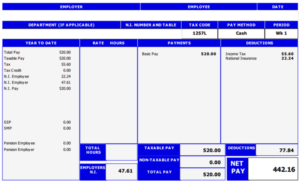

With lenders being more and more risk adverse when it comes to evidence of income, it is important to ensure you are reviewing the documents and can identify potential issues and seek clarification before you proceed.

So, what are the most common areas we see on a payslip that could cause a lender concern?

- Net Pay. Does the net pay match what is being paid on the bank statement? This will almost never be different and if it is, you should ask for an explanation and evidence if available.

- Payment Method. Is the method of payment the same on the payslip as the bank statement? Payslips will confirm how they will be paid, i.e. BACs, CASH or Faster Payment and this should then match the bank statements. If this doesn’t the lender will almost certainly question this.

- Employee Number. Most payslips will have an employee number on them, this is usually given in order of when people joined the firm, so if someone has an employee number of 1, this will normally indicate they are the owner. A quick check can be to look at the employees start date and look at when the company was set up on Companies House. For example, if someone joins a company that has been in place for a number of years, their employee numbers will be quite high.

- Pension Contributions. Most people will have pension contributions included in their payslip, although, people can opt out of this. So, if you see this, ensure you are asking to a reason why.

- Consistency. Payslips will almost always look consistent between months, unless the company has changed software. Therefore, you should be looking out for differences between the payslips you have been given.

Look at the example below and see if you can spot anything that you would query?

Did you spot it?

Considering this is a payslip for the same company for the same week, they should match, but they don’t.

- In the Rate/ Hours section, one has the Basic Pay and number of hours, and the other is blank. Considering this is the same company, the two documents should be identical.

- In the payments section, one has the wording Total Hourly Pay and the other just has Basic Pay. If this wasn’t a joint application, this would be very difficult to spot, so you do have to pay close attention.

- The other issue with this, although you could not spot it, was the fact that the pay method for both was Cash, however, if you reviewed the bank statements, you could see they are paid via bank transfer.

These differences, without any explanation from the adviser, were enough for the lender to decline this case.

If you are ever unsure, you can always ask for copies of their tax documents from the Government Gateway which confirms the amount of tax and NI they pay per month, if this matches the payslips, this will help confirm the pay is genuine, but it isn’t a guarantee.

If you are ever unsure, you can always ask a member of the Compliance department who will be happy to help.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

In recent weeks we have introduced several important OMS updates, and more are in the pipeline for the coming weeks.

Recently we updated the process of moving stages within a case. To ensure that the appropriate fields within each stage are completed, such as advice and offer fees, advisers can no longer skip stages. Instead, each stage must be completed in order and with the relevant tasks updated.

So long as the stages are being completed at the correct time, OMS will now automatically pre-populate the date fields for you, such as

- DIP date

- Application date

- Offer Date

- Completion Date

These changes have made it even more important that advisers set up cases at the appropriate times and follow the stages correctly. Once you have moved a stage forward, you will not be able to move it backwards.

Another big update we have introduced is the product specific file checks. Previously, the file checks would have had tabs for every possible product, but now you will only see questions that relate to the appropriate product.

If you have an older case, your file check may appear to have been removed, but this isn’t the case. All old, completed file checks are still within the file check tab, but are saved in the tab called OLD.

It remains important to set cases up correctly and move them along at the appropriate stage, failure to do this can result in a Network breach, but breaches are easily avoided.

What is a breach?

To avoid anyone getting an email from Compliance that isn’t a nice one, I just wanted to highlight some areas that are considered a breach and let you know what you can do to avoid this.

- Submitting an application to a lender without creating a case on OMS.

- Submitting a case to a lender without having the case checked by Compliance (only for Blue advisers)

- Submitting a case outside of your permissions

- Not completing compliance file check remedials within agreed timeframes

- Not completing your annual Fit and Proper assessment or your annual Observations

There are many other areas that could be considered a breach, but these are the frequent areas we see that advisers sometimes fall foul of.

So, what can you do to avoid a breach?

- Firstly, ensure you create a new case on OMS at the beginning of the process and before you are ready to submit your DIP.

- If you are submitting a regulated case such as a Residential mortgage, Consumer BTL, Regulated Commercial or Bridge loan or a Protection Case, and your adviser status is BLUE, your case will need to be checked and approved by Compliance before you submit your application.

- Ensure you have the appropriate permission before you submit a case. The most common mistake we see is advisers submitting a regulated BTL, Commercial or bridge loan without regulated permissions. To obtain this you will first require a CeMAP (or equivalent) qualification and to have attended the residential training course and passed the subsequent observation.

- For each file check completed, Compliance will advise you of the required time to complete the remedial action. If you are unable to complete this within the timescales, please ensure you communicate with the team and in some situations, an extension can be given.

- Compliance will contact you one month in advance to complete your Fit and Proper and Observations, ensure you complete the required actions within the timeframe given. Not only is not completing your annual Fit and Proper a network and regulatory breach and will result in your access to OMS being restricted until you have completed the appropriate action.

If you have any questions on any of this, please feel free to contact Compliance

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

To further enhance our file checking process and to allow advisers who specialise in non-regulated, or business buy-to-let (BBTL) advice the ability to submit their own DIPs and applications without the requirement to use the Case Management team, the Compliance Department will now be conducting 100% file checking on Business BTL cases for advisers who have not yet achieved Green adviser status.

This will commence from 14th October 2024.

Whilst we already conducted sample checks on these cases, we did not have a formal process in place to allow advisers the ability to submit their own cases. But we do now.

This new process will work in a similar way to that of the file checking and DYA process for Residential mortgages. Any advisers with a Blue or Yellow adviser status will be subject to 100% file checking until they have evidenced competence with the Networks requirements and achieved Green status. Once Green status is achieved, files will then be reviewed on a quarterly basis and advisers will be given the permission to submit their own DIPs and Applications.

We will check BBTL cases post application, so there is no need to send your cases into Compliance. We will instead review all cases submitted and conduct our file review within a specific timeframe or SLA. Feedback will then be given to the adviser in the same way as we do with residential file reviews.

The amount of file checks needed before achieving Green status will differ depending on whether you are an Academy or Experienced.

- Academy advisers will have a minimum of four cases checked

- Experienced will have a minimum of two files reviewed.

So long as these meet the Networks requirements for Business BTL, advisers will be given the ability to submit cases directly to the lender without the use of the Case Management team.

For guidance on the documents required for your BBTL cases, please refer to the minimum documentation Process in BOX HERE

For full guidance on the DYA process for Business BTL cases, please refer to the Operations Manual Here or, contact the Compliance Department who will be happy to help.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

Changes will happen with every business, such as new starters and leavers and when this happens, it is important to keep us informed. Connect are always on hand to provide support with your business needs and can help you with ensuring the process runs as smoothly as possible.

What should you do if you are looking at recruiting a new adviser?

In fact, you should notify us when you are recruiting any members of staff, this could be an adviser, an administrator or even a new controller.

When you are considering recruiting a new member of staff, you should discuss the options with our Business Recruitment Manager, Tracy Robinson tracy@connectmortgages.co.uk

Tracy will discuss all the options with you and let you know what the process is and what information we will need.

Tracy will also discuss any costs and what training Connect offer, which is free of charge for existing firms.

It is also important that we are advised of any new starters so we can complete the required background checks and ensure that your new starter is not a risk to your business.

What should you do if someone has left your firm?

It is also just as important to notify us when someone leaves your firm. This way we can ensure that all system access is removed, and you are paying the correct membership fees.

If someone has left your firm but we haven’t been advised, they will keep their system access and permissions, meaning they could continue to do business under your companies’ authority and name.

If someone in your company is looking to leave, please contact our Compliance Department compliance@connectmortgages.co.uk

Once we are notified of the resignation, we can begin our leavers process, which involves:

- Removal of system access

- Updating membership fees

- Updating the FCA register

If you have any questions or would like to discuss any of the above further, please do not hesitate to contact the Compliance Department, who will be happy to help.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

- Does the Payslip have an employee number?

- Does the employee number make sense? Employee number 1 is normally reserved for the director.

- If they are paid in cash – do the bank statements reflect this?

- Are there any spelling mistakes?

- Deductions – We would normally expect to see Income tax, NI, and maybe a pension. There could be a reason for minimal deductions, such as the income being below the tax thresholds. We would urge you to query any zero deductions with your client.

- Does the address match what you know of the employer? Sometimes it could be different, but that can be queried with your client.

- Does the status say active? Or is it dissolved – we have seen applications in the past from companies that are no longer trading.

- Was the company recently incorporated? Based on the incorporation date, does it tie up when the client told you they started working for the company.

- Always keep the case updated.

- If you cannot get the information from the client – add an ad-hoc document to keep the lender updated.

- Explain as best you can anything unusual about the case or that would warrant further questioning.

When the FCA launched Consumer Duty on 31st July 2023, their goals were to see reduced consumer harm and better outcomes for consumers, outcomes such as:

- Justified and consistent fees based on the products provided.

- Better treatment for vulnerable customers

- Reduced complaints relating to mis-selling

However, research conducted suggest that Some 84% of consumers say there has been no difference in the service they receive from financial providers since Consumer Duty launched.

A desire for human interaction

Consumers said they were most frustrated by the lack of access to human support, this was the view of 48% of people who took the poll.

The poll also identified that 24% complained about financial service providers over-reliance on chatbots.

This is why at Connect we have always emphasised that AI and chatbots are a great way to give customers and staff quicker access to information, but that ‘the human in the loop’ was essential to not become over reliant on this technology and to still give people that human interaction that is so very important.

An email is quick and easy, but it can’t replace a phone call for relaying information and keeping people feeling informed.

So how has Consumer Duty impacted Vulnerable Customers?

A number of people who took this survey said they would define themselves as Vulnerable, according to the FCA’s definition. However, 81% said they had seen no positive improvement in the way they had been treated by financial services companies in the last year.

Research from the FCA says that 47% (or 24.9m) of UK adults display one or more characteristics of vulnerability.

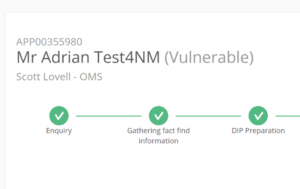

However, reports from our own systems show that only 1% of customers are being registered as Vulnerable, meaning that either advisers are not identifying potentially vulnerable customers or that customers are not confident in disclosing this information, this could be for fear of how we, or lenders, will use this information.

This is why it is so important to have good conversations with customers and use the fact find to help understand their circumstances and make them feel comfortable and confident in disclosing this information.

Lenders are now wanting to ensure that the transition from adviser to lender is as smooth as possible for vulnerable customers and will often ask for this information during the sales process. This way, the customer does not need to repeat this information, and the lender will be able to make the appropriate changes to the way they deal with that person.

Whilst Consumer Duty is an ongoing process, the changes Connect have already made appear to be working. Our complaints records show a consistently low number of complaints and very few complaints raised have been about mis-selling or fees charged.

Our fees policy, which covers all products that we offer and not just those that are regulated, means that all customers will receive a fair and consistent fee for the service provided. The fact that a customer was willing to pay a fee, isn’t evidence that the fee was fair and appropriate, which is why it is important to regularly review your fees and ensure they are inline with the networks standards.

One area we can improve on is having conversations around protection. Since Connect launched the VouchedFor customer surveys, we have seen that there are many instances of customers who wanted to have a conversation about protection, but never did. Not only is this a missed opportunity from a sales point of view, but it also goes against the FCAs desire to reduce foreseeable harm.

Having a conversation with a customer about their need for protection is important in addressing potential future harm, as no one knows what will happen in the future, and having protection in place is a great way to ensure people do not lose their homes should certain unfortunate events happen.

if you need any further information, please contact the Compliance Department who will be happy to help.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Short answer, YES

Last week our Case Management team submitted an application and received an offer from the lender almost instantly.

But how is this possible?

A number of lenders now have AI underwriting, meaning once you have completed the application and packaged the case, the system will review all the information instantaneously and if all is correct, an offer can be produced immediately.

Accuracy of information is vital for this process to work, as any mistakes will be identified by the AI underwriter and will result in a manual review. This will then significantly increase the time to completion.

Now, I am not saying you have to use Case Management for this to happen, but having someone that knows what the lenders want and is diligent in reviewing a case for all the required information before the application is submitted can really help.

Being able to tell an adviser what further information is required and being able to spot any errors, no matter how small, is vital in ensuring the application has the best chance of being accepted. This is all part of the service of the Case Management team and that experience can really help reduce timescales and prevent delays.

Then, once the application is submitted, they do all the chasing and ensure that you are kept in the loop until the case is completed.

Having someone take the reins for you not only reduces the workload on yourself but allows you to move on to new customers. This is the biggest benefit of using the Case Management team.

Just think how happy your customer would be if you were able to give them an offer as quickly as this.

If you need any further information, please contact the Compliance Department who will be happy to help.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

As the sun shines longer and the summer months wind down, the real estate market typically sees a surge in mortgage applications. Many prospective homeowners aim to secure their new homes before the long, dark nights set in. With this seasonal uptick, lenders are ramping up their efforts, enhancing their systems and processes to streamline the application-to-offer timeframe. In some instances, lenders are now issuing offer letters as quickly as the next day, a significant advancement that benefits both buyers and their agents. However, this swift pace does pose challenges, especially for compliance teams who must ensure all regulatory and procedural standards are met.

The Challenge of Compliance

When a case is reviewed by the Compliance Team, whether pre or post-application, any identified remedial work must be completed within 48 working hours. Unfortunately, there has been an increasing number of brokers who fail to meet this 48-hour deadline, leading to unnecessary follow-ups and delays. This lapse in compliance can have serious repercussions. If a case has unresolved remedial issues, it could be at risk of being withdrawn to avoid complications for the broker or the network. Even after an offer has been issued, lenders retain the right to withdraw it if new information surfaces. Additionally, lenders conduct post-completion checks, particularly concerning income verification. Cases have been cancelled when the income declared at the application stage was found to be reduced or unsupported at drawdown.

Best Practices for Brokers

To ensure a smooth process and avoid potential pitfalls, brokers should adopt the following best practices:

- Verify Documentation: Ensure that the documents provided, such as pay slips, match the bank statements. If discrepancies arise, seek additional supporting evidence, such as an HMRC Taxable Income Listing, a letter from the employer, or a copy of the employment contract.

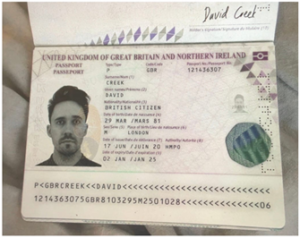

- Confirm Identity Documents: Check that identification documents are signed and current. For driving licenses, verify the place of birth; if it is outside the UK, provide proof of residency.

- Adhere to Deadlines: Complete all remedial work within the 48-hour timeframe. If you anticipate any delays, contact the Compliance Supervisor who sent the initial email and provide an update. Do not leave notes on OMS, as these will not alert the team to the issue.

- Stay Informed: Keep abreast of the latest compliance updates. Regularly check the Network’s communications or log in to LMS and click on the Compliance Updates tab to stay informed of any changes or new guidelines.

Conclusion

As the market heats up and more clients seek to finalize their home purchases before winter, it is crucial for brokers to stay vigilant and compliant. By adhering to these guidelines, brokers can ensure a smoother application process, reduce the risk of delays, and maintain a positive relationship with lenders. Keeping up-to-date with compliance requirements and promptly.

If you need any further information or clarification, please contact the Compliance Department who will be happy to help.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

There are, however, occasions where we are unable to pay commission as quickly as we would like. So here is some guidance on what could cause your commission payment to be delayed.

When commission is received, our Finance Department will first look to find an OMS case to match it to, so when there isn’t a case set up on OMS, no commission can be paid until this is done.

When a case is set up on OMS, that case must have the minimum required amount of information on for us to be able to release your commission. We do this to ensure each case meets the Networks expected standards with regards to quality and so we have sufficient customer information to ensure we are paying the commission correctly.

So, in order to avoid delays and ensure you receive your commission within 3 days, here is a list of requirements that we look for:

For a Mortgage case

- Minimum Documents Attached: Ensure all required documents, including the offer, are attached as per the minimum required documents process HERE.

- Correct Case Stage: Ensure that the case is in the correct stage using the OMS workflows.

- OMS Updates: Application submitted, and case completion dates must be entered into OMS.

- Compliance Check: For advisers not signed off on residential advice, ensure the case has been reviewed by compliance.

- Protection Your Needs Tab: Complete this tab for all regulated cases.

- Adviser Fees: Enter the fees the adviser is charging into either the estimated fees section on the loan details tab or the adviser fees & commission tab.

For a Protection case

- Correct Case Stage: Ensure that the protection case is in the correct stage using the workflows on OMS.

- Insurance Reference Number: Ensure that the insurance reference number is entered into the OMS.

- On Risk Date: Enter the on-risk date into the OMS.

- Documents Attached: Attach all required documents to the case file as per the Protection Process Guide HERE

Full guidance on this policy

Full guidance on this policy can be found in the operations manual, HERE

As with all our policies, there are occasions where we are required to make amendments, so this list may evolve over time.

This is not an exhaustive list of what is required on each case, for this, please ensure you are reviewing and completing the file check tab on OMS.

If you need any further information or clarification, please contact the Compliance Department who will be happy to help.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

The Equity Release Council has introduced a new testing requirement for all of its members. This test must be completed each year to maintain membership and to ensure your knowledge remains current.

We have uploaded this test to the LMS system, and any adviser with Equity Release permissions will be allocated this training to complete. If you do not have Equity Release permissions, you will not be assigned this training.

The test contains only 15 questions, so it will not take long to complete. However, there is a requirement to achieve at least 75% on the test.

So, when does this need to be completed by?

For those who are required to take this test, the deadline set on LMS will show as the 31st of October 2024. Additionally, Equity Release Council members will need to confirm that they have successfully completed the test when they renew their Equity Release membership.

How will I know if I have to take the test?

This test will only be allocated to advisers with Equity Release permissions. If you are unsure whether you have these permissions, you can check your permissions certificate provided by our member support team. If you do not have this certificate, you can contact member support to request another copy: membersupport@connectmortgages.co.uk.

Also, when we allocate this training to your LMS training page, you will receive an email notification to inform you that the training is now ready to complete.

If you have any questions, the Equity Release Council have created a frequently asked questions section, that you can read HERE

They have also created further help for members of the Equity Release Council that can be read HERE

Should you have any questions on this, please do not hesitate to contact myself or the compliance team.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

In July 2023, the FCA’s Consumer Duty rules came into force.

Consumer Duty has been described as the ‘biggest overhaul for the UK’s financial services industry in 20 years’. But what actually changed and what have we learned a year on?

The FCA introduced ‘The Four Outcomes’:

- the governance of products and services

- price and value

- consumer understanding, and

- consumer support

These four outcomes represent key elements of the firm-consumer relationship and were the main areas that we were required to review within our own processes.

If you would like to read more about the FCA Consumer Duty rules, you can read it HERE

Taking into account the requirements of the FCA, we then began the difficult task of ensuring that everything we do as a network met these new requirements.

Following a review of all our policies, processes and customer communications, we made many changes to how we operate, ensuring the customer was at the heart of each decision.

Some of the main changes we made were:

- Introduction of Connect’s Fee Policy, that set out what we believe to be fair charges for customers to receive for each product type.

- We updated all our policies to ensure they were compliant with the new rules.

- Updated our Terms of Business.

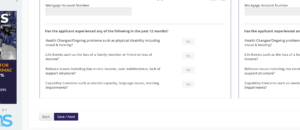

- Updates to OMS to strengthen our Vulnerable Customer process.

- Enhanced our protection process to ensure all our customers receive an appropriate conversation.

- Created a suite of reports to monitor customer outcomes.

So, how has the industry changed one year after Consumer Duty?

Whilst lenders were already monitoring broker fees, this year we have seen more pushback to Networks and brokers where they see fees to be excessive and above what they deem to be appropriate.

Some lenders were already sending reports of cases where a fee is being charged above 1% and asking for our justification, we have now seen lenders set fixed limits on what they will accept. This represents a massive change in the Lender, Broker relationship and something we must work closely together on to ensure that there is no customer detriment. Worst case scenario could be that brokers avoid using certain lenders due to the fee limits they have, this is something we must look to avoid to prevent foreseeable harm to customers.

What can brokers do to remain compliant with the rules?

- The treatment of vulnerable customers was a big part of consumer duty, and we must ensure that customers are not disadvantaged by our processes or communication. Therefore, if you have a customer that may be vulnerable, please make sure you record this on OMS and ensure you are talking to them about how their vulnerability may affect them and what you can do to help? Further guidance on this can be found in our Vulnerable Customer Policy HERE

- Ensure your fees are in line with the Networks Fee Policy and you are recording your fees in OMS. Connect’s Fee Policy can be found HERE

- Completion of the ‘Insurance Your Needs’ tab is important whether you have protection permissions or not. This part of the fact find helps identify where there may be a need for protection. The identification of a need is part of avoiding foreseeable harm. If you identify a need, you will then either provide the advice yourself, or refer to someone who can do it for you. Connect provides training on Protection each month which for network members is always free. You can book yourself on any training course by accessing the training hub HERE

Like TCF, this is not a ‘One and Done’ exercise. Consumer Duty is an ongoing process, and we must continue to review everything we have in place to ensure it remains appropriate and meets on the ongoing requirements of the FCA. What we saw as appropriate last year, may not be appropriate this year, therefore, we may make further changes. However, these will always be communicated so our network members are fully aware.

Should you have any questions on this, please do not hesitate to contact myself or the compliance team.

Regards

Alan Baldwin

Director of Compliance

For any questions or queries, contact the Compliance Team

Call : 01708 676110

Email : compliance@connectmortgages.co.uk

Compliance has checked 500 cases so far this year, so what are the trends that we can learn from?

Last year we enhanced our file checking process and introduced some new initiatives:

- Phone calls to deliver file check feedback

- Heads up process to help new (BLUE) advisers with their learning journey

- Improved file checking scoring system

- Compliance 1-1’s

So far, our new approach has been well received and we have seen an increase in the amount of advisers achieving Competent Adviser Status (CAS). But as well as this we are seeing less repeat mistakes and a steady improvement in the overall file quality.

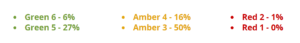

From the 500 cases, what scores do we typically see?

If you were not already aware, below is what the gradings mean:

- 6-Green Advice is suitable, and the file is complete with no missing documents or information.

- 5-Green Advice is suitable, but there are minor fact-find omissions or document omissions (not minimum standard documents) but the omissions are not affecting the advice.

- 4-Amber Advice is suitable, but some documents evidencing advice are missing, or the suitability letter is presented with minor omissions.

- 3-Amber Advice is suitable, but one or more company standard minimum documents are missing, or the suitability letter is presented to the customer with material omissions on the recommendation, requiring re-issue.

- 2-Red Unsuitable advice, eg. mortgage unaffordable, product does not suit customer needs, justification for the advice is not clear.

- 1-Red Suspected fraudulent case, e.g.Back door residential, staged income, fraudulent documentation etc.

So, the typical score we see files graded as is Amber 3, which 50% of the cases checked have been graded, this means that the advice is good, but the cases require some amendments or there are some missing documents. However, it is also worth noting that 33% of cases are graded Green, which shows that generally case quality is very good.